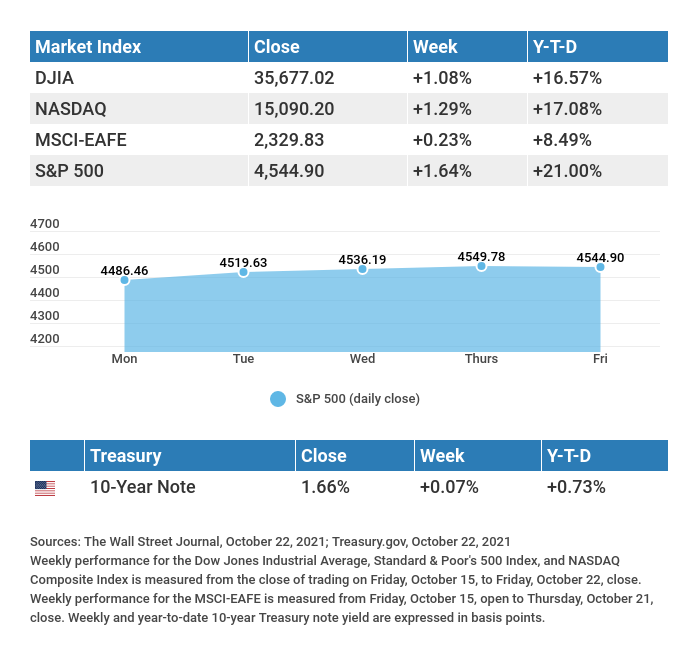

Stocks rallied last week on a stream of positive corporate earnings surprises.

The Dow Jones Industrial Average rose 1.08%, while the Standard & Poor’s 500 advanced 1.64%. The Nasdaq Composite index gained 1.29%for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was up 0.23%.1,2,3

Earnings Ignite Rally

Fears over inflation, supply shortages, and slowing economic growth in China were pushed aside last week as investors reacted to a daily succession of positive corporate earnings surprises. After the Dow Industrials reached an all-time high intraday on Wednesday, fresh earnings reports, an increase in existing home sales, and a new pandemic low in initial jobless claims–and continuing claims–propelled the S&P 500 index to a new record high the following session.4,5

Disappointing earnings before the market opened on Friday hurt a few social media stocks, resulting in a choppy trading session and a selloff in the Nasdaq to close out the week.

Solid Start To Season

Investors came into the earnings season anxious about whether businesses could extend the earnings growth momentum of recent quarters amid an increase in Delta infections, inflation, labor shortages, and supply-chain bottlenecks. The early results were encouraging. Of the 23% of companies comprising the S&P 500 index that have reported, 84% beat Wall Street consensus earnings estimates by an average of more than 13%.6

The earnings season may get more uneven in coming weeks since many of the companies potentially affected by labor shortages and inflation have yet to report. Nevertheless, these better-than-expected earnings buoyed investor spirits and allowed stocks to build on their October gains.

This Week: Key Economic Data

Tuesday: New Home Sales. Consumer Confidence.

Wednesday: Durable Goods Orders.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, October 22, 2021 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Facebook (FB), KimberlyClark Corporation (KMB).

Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Advanced Micro Devices, Inc. (AMD), Twitter, Inc. (TWTR), Visa, Inc. (V), Alphabet, Inc. (GOOGL), Lockheed Martin Corporation (LMT), Eli Lilly and Company (LLY), Texas Instruments (TXN), United Parcel Service (UPS), Capital One Financial Corporation (COF).

Wednesday: The Boeing Company (BA), Ford Motor Company (F), Bristol Myers Squibb Company (BMY), General Motors (GM), Twilio, Inc. (TWLO), CocaCola Company (KO), McDonald’s Corporation (MCD), GlaxoSmithKline (GSK), ServiceNow, Inc. (NOW), Spotify Technology (SPOT), General Dynamics Corporation (GD).

Thursday: Apple, Inc. (AAPL), Mastercard (MA), Caterpillar, Inc. (CAT), Starbucks Corporation (SBUX), Merck & Company, Inc. (MRK), Shopify, Inc. (SHOP), Northrop Grumman Corporation (NOC), Comcast Corporation (CMCSA), Illinois Tool Works, Inc. (ITW).

Friday: AbbVie, Inc. (ABBV), Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), LyondellBasell Industries N.V. (LYB).

Source: Zacks, October 22, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Give what you have to somebody; it may be better than you think.” – Henry Wadsworth Longfellow

Tax Tips on Identity Theft

Here are a few things to know when attempting to protect yourself against identity thieves:

The IRS never will contact you via email or phone to request personal information. If you receive a scam email or call that claims to be from the IRS, report it to phishing@irs.gov.

People can steal your identity by stealing your wallet or purse, receiving information they need over the phone or email, finding your personal information in the trash, or accessing information you provide to an unsecured website (only enter credit card information on websites that start with “http://”).

Your identity may have been stolen if you receive a letter from the IRS indicating that more than one tax return was filed in your name.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov7

The Health Benefits of a Meat-Free Day

There’s no denying the overwhelming health benefits of a plant-based diet. You still can enjoy such a diet’s many health benefits by going “meat free” for just one day a week. Here are some of the main benefits:

- You’ll be cutting out potentially dangerous processed meat – According to the World Health Organization, processed meats rank alongside cigarettes as a major cause of cancer.

- You’ll be decreasing your risk of heart disease – Coronary heart disease is linked to a meat-based diet, and most cardiovascular diseases can be prevented by switching to a plant-based diet.

- You’ll be getting more vitamins, minerals, and fiber – When you don’t turn to meat on your meat-free day, you’ll likely turn to other foods such as veggies, fruits, whole grains, and other plant-based products. This variety helps you round out your diet!

Tip adapted from Hello Magazine8

If you add 1.5 to this number, you will get the same result as you would if you multiplied it by 1.5. What number is it? (Hints: It is a whole number, it is not zero, and it is between 1 and 10.)

Last week’s riddle: : What nine-letter word begins and ends with the letter “S” and has only one vowel?

Answer:: Strengths.

Surveyor near Seljalandsfoss waterfall, Iceland.

Footnotes and Sources

1. The Wall Street Journal, October 22, 2021

2. The Wall Street Journal, October 22, 2021

3. The Wall Street Journal, October 22, 2021

4. CNBC, October 20, 2021

5. The Wall Street Journal, October 21, 2021

6. FactSet, October 22, 2021

7. IRS.gov, June 8, 2021

8. hellomagazine.com, June 24, 2021

8. breastcancer.org, June 24, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.