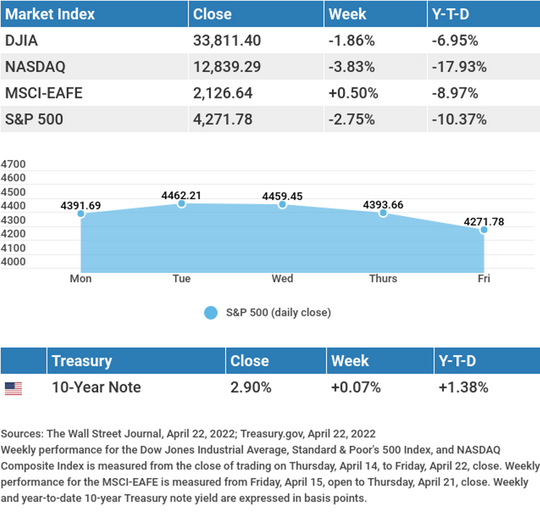

Hawkish comments from Fed Chair Jerome Powell overshadowed many largely positive earnings results, sending stocks lower for the week.

The Dow Jones Industrial Average declined 1.86%, while the Standard & Poor’s 500 dropped 2.75%. The Nasdaq Composite index fell 3.83% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 0.50%.1,2,3

Focus Comes Off Earnings

With the inflation report in the rearview mirror and a Fed meeting two weeks away, many may have expected corporate earnings to be in focus last week. Comments by Jerome Powell stole the spotlight.

Investors began the week awaiting earnings reports looking for insight into businesses handling the latest inflation, a jittery consumer, tighter monetary policy, and ongoing supply chain issues. Despite one high-profile earnings disappointment, corporate profits appeared better than expected. By the time trading began on Thursday, 17% of S&P 500 companies had reported, and 81% had beaten Wall Street analysts’ estimates. Investors responded positively, sending share prices higher until Powell’s comments on Thursday afternoon triggered selling into the day’s close and accelerated through Friday.4

Powell Unnerves Markets

On Thursday, at an event hosted by the International Monetary Fund, the Fed Chair offered his view that it may be appropriate to move more quickly on raising interest rates. He indicated that a 50 basis point hike was on the table for the Federal Open Market Committee (FOMC).5

His comments also emphasized the need to restore price stability, recalling the successful efforts of former Fed Chair Paul Volker, who used a series of rate hikes to tame the inflation of the 1970s and early 1980s. While some observers anticipated these comments, yields rose, and stocks fell in response.

This Week: Key Economic Data

Tuesday: Durable Goods Orders. Consumer Confidence. New Home Sales.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, April 22, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: The Coca-Cola Company (KO).

Tuesday: Microsoft Corporation (MSFT), Visa, Inc. (V), Alphabet, Inc. (GOOGL), General Motors Company (GM), Archer Daniels Midland Company (ADM), 3M Company (MMM), Texas Instruments, Inc. (TXN), United Parcel Service, Inc. (UPS), D.R. Horton, Inc. (DHI), Chipotle Mexican Grill, Inc. (CMG).

Wednesday: Meta Platforms, Inc. (FB), The Boeing Company (BA), Ford Motor Company (F), Qualcomm, Inc. (QCOM), PayPal Holdings, Inc. (PYPL), Amgen, Inc. (AMGN), ServiceNow, Inc. (NOW), Norfolk Southern Corporation (NSC).

Thursday: Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), Intel Corporation (INTC), Mastercard, Inc. (MA), Caterpillar, Inc. (CAT), Merck & Co., Inc. (MRK), McDonald’s Corporation (MCD), The Southern Company (SO), Eli Lilly and Company (LLY), Northrop Grumman Corporation (NOC).

Friday: AbbVie, Inc. (ABBV), Exxon Mobil Corporation (XOM), Bristol Myers Squibb Company (BMY), Chevron Corporation (CVX), Honeywell International, Inc. (HON), Colgate-Palmolive Company (CL), L3Harris Technologies, Inc. (LHX).

Source: Zacks, April 22, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“You don’t need a weatherman to know which way the wind blows.” – Bob Dylan

Be On the Lookout for Unemployment Identity Theft Scams

With millions of people receiving unemployment, it’s no surprise that scammers are taking advantage of this situation and filing fraudulent claims for unemployment compensation. They do this by using stolen personal information of taxpayers who haven’t filed unemployment claims.

If you filed for unemployment and received an incorrect Form 1099-G, make sure to contact the issuing agency to request a revised form. You can also contact the IRS and request an identity protection PIN to protect your identity when filing your federal tax return. Make sure to also educate yourself on the many signs of identity theft and take the proper steps to protect yourself.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Tips for Making Cleaning Your Closet Easier

There’s something so satisfying about cleaning out your closest, especially during this time of year. Here are some tips on how to make spring cleaning your closet a little easier.

- Not sure what to keep or get rid of? Try the clothes hanger hack! Turn all your coat hangers around so they face away from you and over the course of a month or two, turn the hangers around as you wear your clothes. Then, you can see what you actually wear and clean out your closet accordingly.

- Separate your clothes by season and neatly pack away the clothes you aren’t wearing right now for future use. You can use a vacuum sealer to save space. Make sure to label your storage containers or bags so you remember what’s in each one.

- Save space by shopping for wardrobe accessories like shoe organizers, slimmer hangers, or necklace/scarf organizers.

Tip adapted from Who What Wear7

Wilson, Xavier, Yolanda, and Zach are standing in line at the market. See if you can figure out their order from these clues: Yolanda is between Wilson and Xavier, Zach is next to Wilson, and Xavier is not first.

Last week’s riddle: How much dirt is in a 2-foot diameter hole that is 4 feet deep?

Answer: No dirt at all. You have made a hole by digging out the dirt, so the hole is empty.

The Incan citadel of Machu Picchu, high in the Andes Mountains, Peru.

Footnotes and Sources

1. The Wall Street Journal, April 22, 2022

2. The Wall Street Journal, April 22, 2022

3. The Wall Street Journal, April 22, 2022

4. CNBC, April 21, 2022

5. CNBC, April 21, 2022

6. IRS.gov, February 24, 2021

7. whowhatwear.com, March 19, 2020

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.