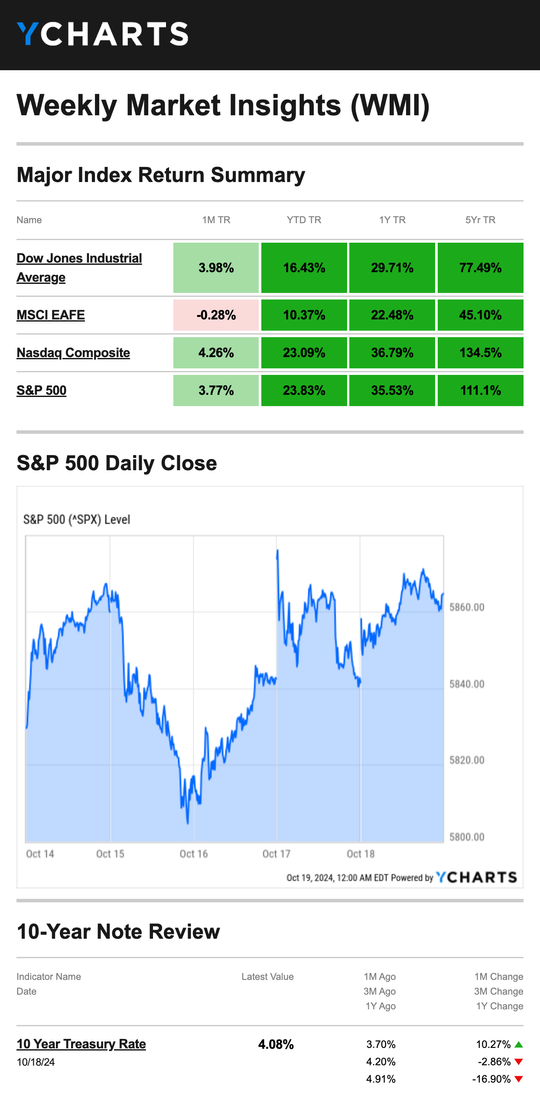

Stocks posted modest gains last week, with quarterly earnings season in full swing and the election on the horizon.

The Standard & Poor’s 500 Index increased 0.85 percent, while the Nasdaq Composite Index rose 0.80 percent. The Dow Jones Industrial Average advanced 0.96 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.31 percent.1,2

Six in a Row

Stocks bolted out of the gate as the week began. The S&P 500 and the Dow Industrials hit record highs, with the Dow crossing 43,000 for the first time.3

Midweek, news of stronger-than-expected retail sales report contributed to overall market momentum. Retail sales rose a seasonally adjusted 0.4 percent in September, topping economists forecasts.4

As the week wrapped up, the technology sector helped fuel a rally that pushed the S&P and Nasdaq to another record high. It was the sixth straight week of gains for the S&P 500, Nasdaq, and Dow Industrials.5

Source: YCharts.com, October 19, 2024. Weekly performance is measured from Monday, October 14, to Friday, October 18. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Insight from Corporate Reports

There were many market forces pushing each other around last week.

Corporate earnings reports drove much of the market action. Some of the most extensive financial stocks surprised on the upside, supporting a narrative that the economy remains strong.

At the same time, a corporate report from one of the world’s largest chip manufacturing contractors revealed continued strong global demand for AI microchips. However, increasing investor anxiety was a constant undertow in trading as the November elections drew nearer.6

This Week: Key Economic Data

Monday: Fed Officials Lori Logan, Neel Kashkari, and Jeffrey Schmid speak.

Tuesday: Fed Official Patrick Harker speaks.

Wednesday: Existing Home Sales. Beige Book. Fed Officials Michelle Bowman and Thomas Barkin speak.

Thursday: New Home Sales. Weekly Jobless Claims. Fed Official Beth Hammack speaks.

Friday: Durable Goods. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; October 18, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: GE Aerospace (GE), Philip Morris International Inc. (PM), Verizon Communications Inc. (VZ), Texas Instruments Incorporated (TXN), RTX Corporation (RTX), Lockheed Martin Corporation (LMT), Fiserv, Inc. (FI)

Wednesday: Tesla, Inc. (TSLA), The CocaCola Company (KO), T-Mobile US, Inc. (TMUS), Thermo Fisher Scientific Inc. (TMO), International Business Machines Corporation (IBM), ServiceNow, Inc. (NOW), AT&T Inc. (T), Boston Scientific Corporation (BSX), The Boeing Company (BA)

Thursday: Amazon.com, Inc. (AMZN), S&P Global Inc. (SPGI), Union Pacific Corporation (UNP), United Parcel Service, Inc. (UPS)

Source: Zacks, October 18, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Never be limited by other people’s limited imaginations.” –Mae Jemison

Tax Incentives Can Help You Further Your Education

Tax credits help with the cost of higher education by managing the income tax you may need to pay. The two tax credits available are the American Opportunity Tax Credit and the Lifetime Learning Credit.

Some education savings plans offer tax benefits if the individual qualifies. Also, you may be able to deduct higher education costs – such as tuition, student loan interest, and qualified education expenses – from your tax return.

Knowing your potential tax benefits may save you money if you’ve always dreamed about returning to school, whether to further your career or just learn something new.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

The Benefits of Brain Training

We know how important it is to exercise our bodies, but exercising our brains is just as important. When we continue to learn, our brains are better for it. Here are just a few benefits of “brain training,” or exercising your brain:

- Improved executive functions

- Improved working memory

- Improved processing speed

- Preserved cognitive health

- Fewer problems with daily functioning

- Better control over mental processing abilities

There are many fun ways to exercise your brain, one of which is to continue learning new things. Attend a pottery, painting, or foreign language class in your neighborhood, or check for discounts on community college courses. Another great way to exercise your brain is to socialize with others, spend time in nature, and practice mind puzzles, such as crosswords, Sudoku, or a game in a brain-training app.

Tip adapted from American Psychological Association8

Two lions (Panthera leo) resting high up in a tree

Moremi Game Reserve, Okavango Delta, Botswana

Footnotes and Sources

1.The Wall Street Journal, October 18, 2024

2. Investing.com, October 18, 2024

3.CNBC.com, October 15, 2024

4.The Wall Street Journal, October 17, 2024

5.The Wall Street Journal, October 18, 2024

6.The Wall Street Journal, October 18, 2024

7. IRS.gov, July 3, 2024

8.American Psychological Association, July 24, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may no

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.