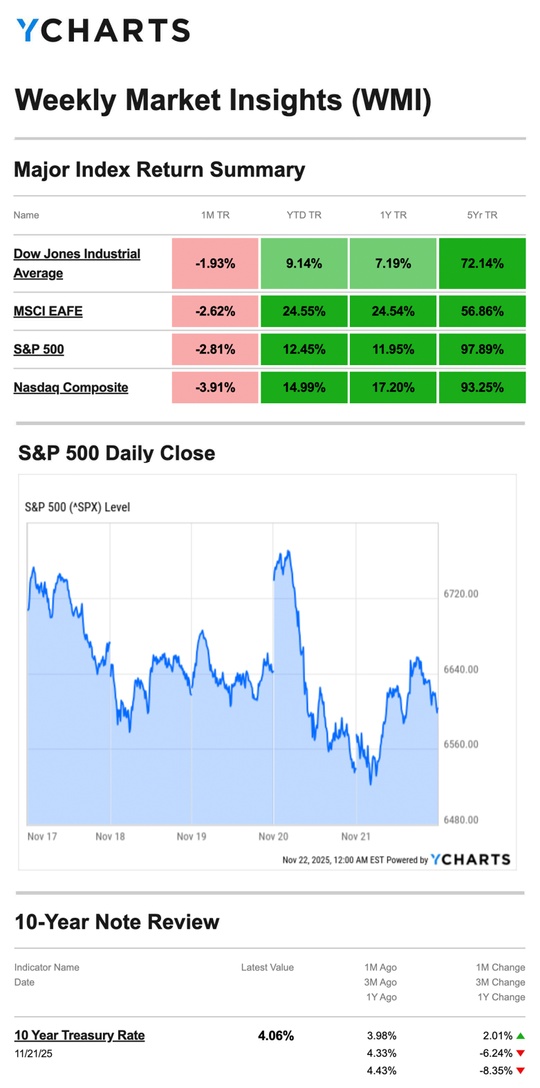

Heightened volatility was on Wall Street’s mind last week, as investors continued to focus on valuations of artificial intelligence (AI) stocks.

The Standard & Poor’s 500 Index fell 1.95 percent, while the Nasdaq Composite Index declined 2.74 percent. The Dow Jones Industrial Average slid 1.91 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slumped 3.25 percent.1,2

AI Valuation Worries

Stocks slid over the first half of the week as anticipation continued to build for Q3 results from one of the largest AI megacap tech stocks, due out midweek.

While the decline was led by megacap tech stocks, which typically drag down both the Nasdaq and S&P 500, the Dow Industrials also fell. With the government still playing catch-up on a backlog of economic reports following the shutdown, investors kept a close eye on big consumer related stocks for insights into the economy.3

Then midweek, all three major averages rebounded, with the S&P snapping a four-day losing streak. Sentiment improved as investors turned more positive about another AI firm’s quarterly report due out after Wednesday’s closing bell.4

That firm’s results helped boost stocks after the opening bell on Thursday, but prices retreated quickly as investor anxiety built over whether the Fed would adjust rates next month. The Fed’s October meeting minutes revealed divisions among the Committee’s voting members. Additionally, the Labor Department’s September jobs report painted a mixed employment picture, which might complicate the Fed’s decision.5

Stocks rebounded on Friday after New York Fed President John Williams seemed to reassure investors that a rate adjustment at the Fed’s December meeting was still a possibility. The bounce was jagged, as the rebound had to battle through disappointing economic data on consumer sentiment and manufacturing activity.6

Source: YCharts.com, November 22, 2025. Weekly performance is measured from Monday, November 17, to Friday, November 21. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

More Jobs, but Higher Jobless Rate

The delayed September jobs report came out last week, and showed employers added 119,000 jobs—the strongest monthly gain since April and a rebound from August’s loss of 4,000 jobs (which was later revised to a 22,000 gain). The jobs report was among the first post-shutdown reports to be published by the Labor Department.

The unemployment rate in September rose to 4.4 percent, higher than the 4.3 percent economists expected. It was the highest number in four years.

This was the Labor Department’s last monthly employment report before the Federal Reserve’s next meeting on December 9-10.7

This Week: Key Economic Data

Tuesday: Retail Sales (Sept). Case-Shiller Home Price Index (Sept). Business Inventories (Sept). Consumer Confidence. Pending Home Sales.

Wednesday: Weekly Jobless Claims. Durable Goods Orders (Sept).

Thursday: THANKSGIVING HOLIDAY—MARKETS CLOSED

Friday: Chicago Business Barometer.

Source: Investors Business Daily – Econoday economic calendar; November 21, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Agilent Technologies (A)

Tuesday: Analog Devices, Inc. (ADI), Dell Technologies Inc. (DELL), Autodesk, Inc. (ADSK), Workday, Inc. (WDAY)

Wednesday: Deere & Company (DE)

Source: Zacks, November 21, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Your time is limited, so don’t waste it living someone else’s life.” – Steve Job

Outstanding Tax Bill? Consider an Offer in Compromise

An Offer in Compromise is a federal tax program that allows taxpayers to enter into an agreement with the IRS to settle their tax debt for less than the amount they owe. This agreement is an option when taxpayers can’t pay their full tax liabilities or when paying the entire balance owed would cause financial hardship. The goal is a compromise that suits the best interests of both parties.

The IRS considers various circumstances when reviewing OIC applications, including the applicant’s:

- Income

- Expenses

- Asset equity

There is also an application to apply for an OIC. Taxpayers who meet the definition of a low-income taxpayer don’t have to pay this fee.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov8

It’s All in a Walk: 3 Tips for Integrating Walking Into Your Day

Getting more movement is always a good idea, but finding the time to fit a walk into your day can be hard. These tips will make it easier to get up and get moving:

-

Keep a pair of sneakers in your car to walk whenever you have a few extra minutes! This could be during your lunch break at work, if you’re early for a doctor’s appointment, or while you’re waiting to pick up the kids from school.

-

Walk when you might otherwise sit. We’re always waiting for something, so walk around instead of sitting while you wait! It’s okay if you can’t go far; at least you’re getting your steps in.

- Have multiple routes, so you don’t get bored walking the same route daily.

- Invite friends for a walk instead of getting coffee or lunch.

Tip adapted from Help Guide9

Eurasian Lynx

Bavaria, Germany

Footnotes and Sources

1.WSJ.com, November 21, 2025

2. Investing.com, November 21, 2025

3.CNBC.com, November 18, 2025

4.CNBC.com, November 19, 2025

5.WSJ.com, November 20, 2025

6.CNBC.com, November 21, 2025

7.WSJ.com, November 20, 2025

8. IRS.gov, May 22, 2025

9.HelpGuide.org, June 12, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security

Copyright 2025 FMG Suite.