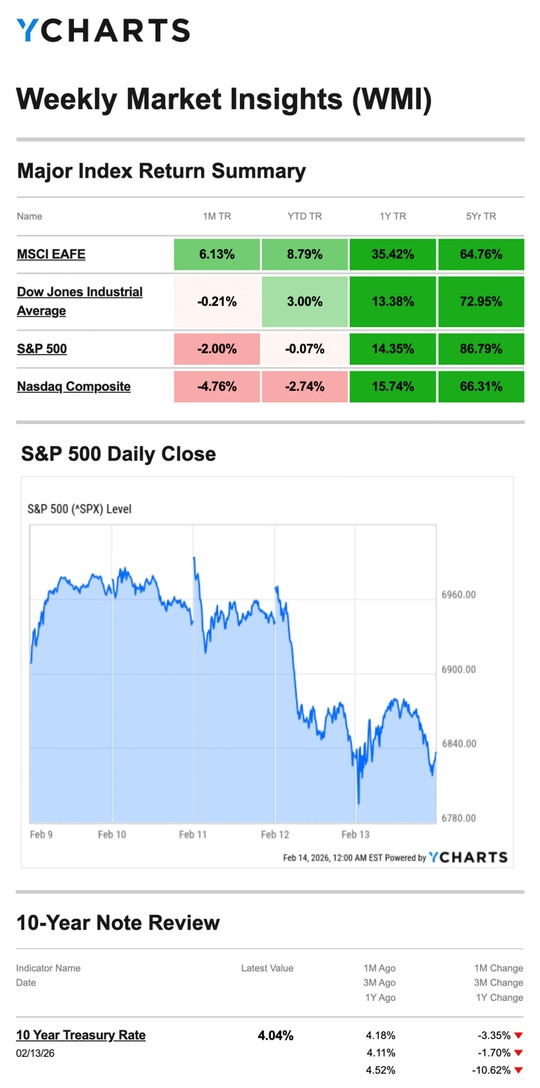

The Standard & Poor’s 500 Index fell 1.39 percent, while the Nasdaq Composite Index declined 2.10 percent. The Dow Jones Industrial Average slid 1.23 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.92 percent.1,2

AI Disruption Fears

Big tech started last week back in the driver’s seat, leading the Nasdaq and S&P 500 to modest gains as investors appeared cautiously optimistic about the economy and Q4 corporate reports.3

Stocks slid modestly on Tuesday after December retail sales were flat, sparking some anxiety about the economy. Investors also fretted about the impact of artificial intelligence (AI) on financial stocks.4

A stronger-than-expected jobs report initially sparked a rally midweek, but momentum quickly faded as investors dug deeper into the numbers.

Stocks then came under pressure as AI disruption fears spread across several industry groups. Traders worried that AI would disrupt certain business models and possibly increase unemployment.5

Markets rebounded following Friday’s Consumer Price Index (CPI) reading, which gave investors another economic data point to cheer as the pace of inflation slowed in January.6

Source: YCharts.com, February 14, 2026. Weekly performance is measured from Monday, February 9, to Friday, February 13. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Good News, Bad News

Investors focused on three key economic reports out last week: retail sales, jobs, and inflation. Here are the key good news/bad news takeaways from each report:

Retail sales: Consumer spending was flat in December, below expectations and below November’s 0.6 percent growth. Good news: Given that two-thirds of the economy runs on consumer spending, the Fed may reconsider its wait-and-see stance on raising rates.7

Employment: January job growth was mostly concentrated in a single sector. Plus, downward revisions showed employers only added 181,000 jobs last year—70 percent fewer than initially thought. There was essentially no job growth in the back half of 2025. Good news: January job growth was more than double what economists expected—the biggest gain in over a year. The unemployment rate also edged down.8

Inflation: Inflation was cooler-than-expected but remains above the Fed’s target. Good news: The CPI’s 2.4 percent year-over-year growth in January marked a drop from December’s 2.7 percent annual pace.9

This Week: Key Economic Data

Monday: Markets closed for Presidents’ Day

Tuesday: Empire State Manufacturing Survey

Wednesday: Housing Starts (Nov., Dec.). Building Permits (Nov., Dec.). Durable Goods (Dec.). Trade Balance in Goods (Dec.). Retail Inventories (Dec.). Wholesale Inventories (Dec.). Federal Open Market Committee Meeting Notes (Jan.).

Thursday: Weekly Jobless Claims. Trade Deficit (Dec.). Pending Home Sales. Minneapolis Fed President Neel Kashkari speaks.

Friday: Gross Domestic Product (GDP), Q4. Personal Consumption Expenditures (PCE) Index (Dec.). New Home Sales (Nov., Dec.). Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar: February 13, 2026.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Medtronic (MDT), Palo Alto Networks, Inc. (PANW), Constellation Energy Corporation (CEG), Cadence Design Systems, Inc. (CDNS)

Wednesday: Analog Devices, Inc. (ADI), Booking Holdings Inc. (BKNG), Carvana Co. (CVNA), DoorDash, Inc. (DASH), Moody’s Corporation (MCO)

Thursday: Walmart Inc. (WMT), Deere & Company (DE), Newmont Corporation (NEM), The Southern Company (SO)

Source: Zacks, February 13, 2026. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your goals, time horizon, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule their earnings reports without notice.

“I can make it through the rain, I can stand up once again on my own, and I know that I’m strong enough to mend.”–Mariah Carey

Be On Alert for IRS Scams

The Internal Revenue Service is on a constant lookout for tax-related scams. In most cases, “phishing” scams are bogus phone calls and emails that claim to come from the IRS.

Remember, the IRS will never:

- Call you without mailing an official notice first.

- Demand that you immediately pay your taxes over the phone.

- Take a debit or credit card number over the phone.

- Threaten to call law enforcement or immigration services to arrest you for failure to pay.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov10

Loving Yourself First

The rise of self-care over the past decade has brought attention to the concept of loving oneself – the basic philosophy behind it being that if we love and take care of ourselves with intention, the happier and healthier we’ll be, and all the people in our lives will benefit.

Loving ourselves isn’t always easy. And it doesn’t mean always being overly indulgent, but rather making choices that help support our overall well-being. For some people, that may look like taking time to relax if they have a lot of stress. For others, it can be making a to-do list to organize and accomplish tasks if they tend toward procrastination. It can also mean being more self-aware and cheering ourselves on if we’re often overly harsh or being more introspective and searching for ways to improve if we are myopic about our shortcomings. All these things and many more not mentioned are intentional actions we can take to be our best selves.

Take some time to reflect on the ones you love. Just make sure you don’t forget about the one you should love the most.

Tip adapted from Everyday Health11

The Milford Sound fiord

Fiordland National Park, New Zealand

Footnotes And Sources

1.WSJ.com, February 13, 2026

2. Investing.com, February 13, 2026

3.CNBC.com, February 9, 2026

4.CNBC.com, February 10, 2026

5.CNBC.com, February 12, 2026

6.WSJ.com, February 13, 2026

7.CNBC.com, February 10, 2026

8.WSJ.com, February 11, 2026

9.WSJ.com, February 13, 2026

10. IRS.gov, May 29, 2023

11.Everyday Health, August 25, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2026 FMG Suite.