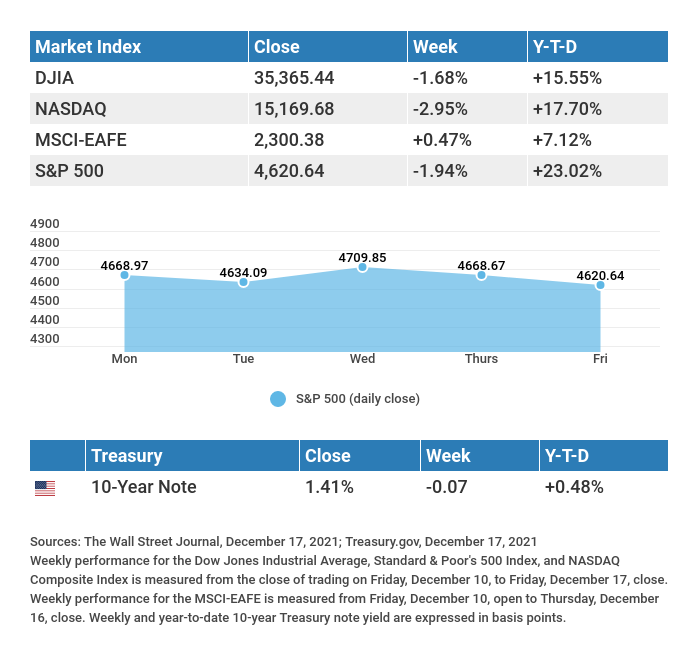

Stock prices retreated last week as global central banks joined the Federal Reserve in taking steps to tighten monetary policy.

The Dow Jones Industrial Average fell 1.68%, while the Standard & Poor’s 500 dropped 1.94%. The Nasdaq Composite index tumbled 2.95% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, managed a gain of 0.47%.1,2,3

From Uncertain to Unsettled

Stocks weakened ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting as investors weighed how aggressive the Fed might be in reversing its easy-money policies. Investor sentiment was further dented by disappointing economic data. Retail sales fell short of expectations and a year-over-year jump of 9.6% in producer prices reflected price pressures that may translate into higher future consumer prices. It was the highest percentage increase since records started in 2010.4

The market initially responded well to the FOMC announcement on Wednesday afternoon, but became unsettled into Thursday and Friday over a tighter monetary policy and Omicron concerns.

A New Fed Narrative

After the FOMC meeting, the Fed announced a plan to quicken the tapering of its monthly bond purchases. It plans to double the rate from $15 billion a month (announced in November) to $30 billion a month, effectively putting an end to asset purchases by March 2022. The Fed also signaled that as many as three rate hikes may be coming in 2022.5

The Fed cited elevated inflation and an improved labor market as justification for the pivot from its pandemic-related, easy-money policies. Reflecting the persistence of higher-than-anticipated inflation, the Fed raised its previous inflation estimates for this year and 2022.6

Final Note

Our weekly market commentary will not be published next week. We want to take this opportunity to wish you and your family a wonderful holiday season and a very happy and prosperous new year!

This Week: Key Economic Data

Monday: Index of Leading Economic Indicators. FOMC (Federal Open Market Committee) Announcement.

Wednesday: GDP (Gross Domestic Product). Consumer Confidence. Existing Home Sales.

Thursday: Durable Goods Orders. Jobless Claims. New Home Sales. Consumer Sentiment.

Source: Econoday, December 17, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases

(including key economic indicators), Federal Reserve policy meetings, and speaking

engagements of Federal Reserve officials. The content is developed from sources

believed to be providing accurate information. The forecasts or forward-looking

statements are based on assumptions and may not materialize. The forecasts also

are subject to revision.

This Week: Companies Reporting Earnings

Monday: Micron Technology, Inc. (MU), Nike, Inc. (NKE).

Tuesday: General Mills, Inc. (GIS).

Wednesday: Cintas Corporation (CTAS), Paychex, Inc. (PAYX).

Source: Zacks, December 17, 2021

Companies mentioned are for informational purposes only. It should not be

considered a solicitation for the purchase or sale of the securities. Investing involves

risks, and investment decisions should be based on your own goals, time horizon, and

tolerance for risk. The return and principal value of investments will fluctuate as

market conditions change. When sold, investments may be worth more or less than

their original cost. Companies may reschedule when they report earnings without

notice

“Keep your thoughts free from hate, and you need have no fear from those who hate you.” – George Washington Carver

Is Your Office in a Historic Building? You May Be Eligible for a Tax Credit

In an effort to protect heritage sites and other history, the IRS implemented its rehabilitation tax credit, which offers an incentive to renovate and restore old or historic buildings. Here are some of the highlights to help you determine whether your building is eligible:

-

- The credit may pay for 20% of the qualifying costs of rehabilitating a historic building.

- This 20% needs to be spread out over five years

- This 20% needs to be spread out over five years

- Taxpayers use Form 3468, Investment Credit, to claim the rehabilitation tax credit.

Although this credit might not move the needle a significant amount in a lot of situations, it’s still a step in the right direction in trying to preserve our country’s history.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov7

Neck and Shoulder Stretches for Desk Potatoes

Many of us sit at a desk for hours a day and stare at a screen. These easy desk stretches can help:

-

-

- Overhead side stretch: While sitting up straight, put your arms over your head and lean to one direction. Repeat on the other side.

- Side-neck stretch: Gently put your hand on the back of your head and guide it to your chest. Then, instead of putting your head straight down, turn it slightly by looking at your thigh.

- Neck-roll stretch: Relax and lean your head forward, slowly roll it to one side and hold for about 10 to 20 seconds, then slowly roll it to the other side

- Upper-trap stretch: Gently pull your head toward each shoulder. Hold on each side for 10 to 20 seconds

-

Tip adapted from Healthline8

Tim hands a friend $63 using six bills, none of which are dollar bills. How is he able to do this?

Last week’s riddle: : I never ask you questions, yet you answer me all the time. What am I?

Answer: A phone.

Dawn meets the Aurora Borealis in Arctic village, Lofoten archipelago, Norway.

Footnotes and Sources

1. The Wall Street Journal, December 10, 2021

2. The Wall Street Journal, December 10, 2021

3. The Wall Street Journal, December 10, 2021

4. CNBC, December 10, 2021

5. The Wall Street Journal, December 10, 2021

6. IRS.gov, June 16, 2021

7. American Psychological Association, June 24, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan

Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is anunmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2021 FMG Suite.