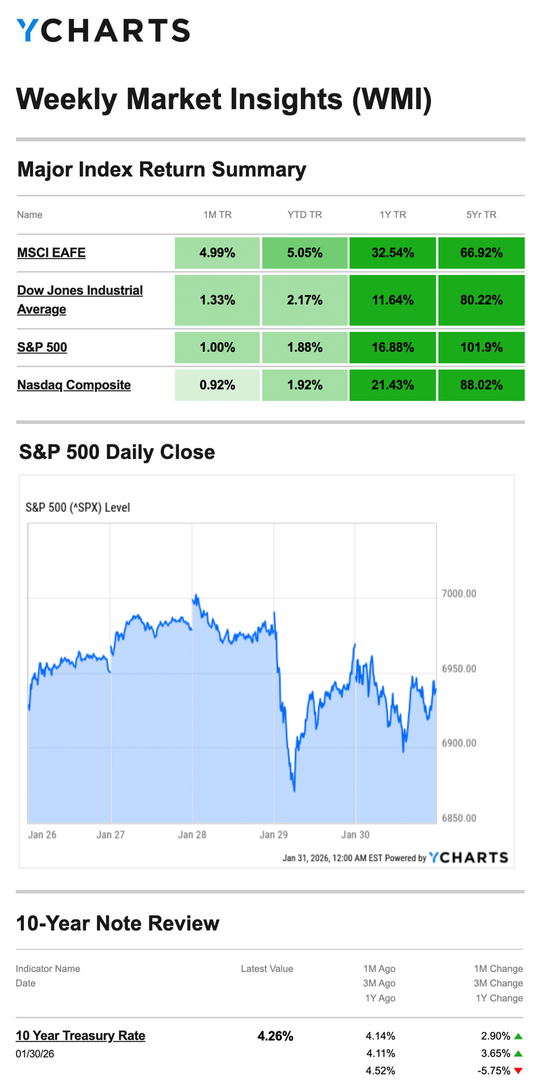

Stocks were mixed last week as investors navigated Q4 corporate results, a widely expected Fed decision, and a handful of economic reports.

The Standard & Poor’s 500 Index rose 0.34 percent, while the Nasdaq Composite Index edged down 0.17 percent. The Dow Jones Industrial Average declined 0.42 percent. By contrast, the MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.22 percent.1,2

S&P 500 Touches 7,000

The S&P 500 and Nasdaq advanced early in the week as investors looked ahead to the Fed meeting and corporate results from several large companies.3,4

On Wednesday, the Federal Reserve decided to keep interest rates steady, as widely expected. Market reaction was muted, with all three major averages little changed by the close. Disappointing earnings results from one megacap tech firm, announced after the market closed on Wednesday, unsettled investors and dragged the Nasdaq down on Thursday.5,6

Stocks opened lower Friday, after the White House nominated Fed veteran Kevin Warsh as the next Fed chair. A warmer-than-expected December wholesale inflation report and concerns about a government shutdown added to bearish investor sentiment as the week wrapped up.7

Source: YCharts.com, January 31, 2026. Weekly performance is measured from Monday, January 26, to Friday, January 30. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Fed Holds Steady

The Fed funds rate was held at its current 3.5 percent to 3.75 percent target range at its January meeting. The decision followed three consecutive meetings at which the Fed cut rates; it marked the first time the Fed held rates steady since July. The next Fed meeting is in mid March.8

At the post-meeting press conference, Fed Chair Powell did not answer any questions regarding the Justice Department’s investigation. The January 19, 2026, issue of Weekly Market Insights misstated the status of the investigation concerning the Fed Chair by referring to it as an indictment. We regret any confusion.

This Week: Key Economic Data

Monday: Auto Sales. Institute for Supply Management (ISM) Manufacturing Index.

Tuesday: Institute for Supply Management (ISM) Services Index. Job Openings (December)

Wednesday: ADP Employment Report.

Thursday: Weekly Jobless Claims. Atlanta Fed President Raphael Bostic speaks.

Friday: Jobs Report. Consumer Sentiment. Consumer Credit.

Source: Investors Business Daily – Econoday economic calendar: January 30, 2026. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Palantir Technologies Inc. (PLTR), The Walt Disney Company (DIS)

Tuesday: Advanced Micro Devices, Inc. (AMD), Merck & Co., Inc. (MRK), PepsiCo, Inc. (PEP), Amgen Inc. (AMGN), Pfizer Inc. (PFE), Chubb Limited (CB)

Wednesday: Alphabet Inc. (GOOG/GOOGL), Eli Lilly and Company (LLY), AbbVie Inc. (ABBV), Uber Technologies, Inc. (UBER), QUALCOMM Incorporated (QCOM), Boston Scientific Corporation (BSX), CME Group Inc. (CME), McKesson Corporation (MCK)

Thursday: Amazon.com, Inc. (AMZN), ConocoPhillips (COP), Bristol Myers Squibb Company (BMY), KKR & Co. Inc. (KKR)

Friday: Philip Morris International Inc. (PM)

Source: Zacks, January 30, 2026. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your goals, time horizon, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule their earnings reports without notice.

“Good habits, imperceptibly fixed, are far preferable to the precepts of reason.” – Mary Wollstonecraft

Know and Understand Your Correct Filing Status

Taxpayers should understand their filing status well and at least be familiar with the other choices.

When preparing and filing a tax return, the filing status affects:

- If the taxpayer is required to file a federal tax return

- Their standard deduction amount

- If they can claim certain credits

- The amount of tax they should pay

Here are the five filing statuses:

Single: This status is normally for taxpayers who are unmarried, divorced, or legally separated under a divorce or separate maintenance decree governed by state law.

Married filing jointly: If a taxpayer is married, they can file a joint tax return with their spouse. When a spouse passes away, the widowed spouse can usually file a joint return for that year.

Married filing separately: Married couples can choose to file separate tax returns in certain circumstances.

Head of household: Unmarried taxpayers may be able to file using this status, but special rules apply.

Qualifying widow(er) with dependent child: This status may apply to a taxpayer if their spouse died during one of the previous two years and they have a dependent child. Other conditions also apply.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Keeping Your Heart Rate Up Indoors

A rainy day can steal our motivation to leave the comfort of our homes unless we have to. But your workouts don’t need to stop during inclement weather. Here are a few ways to feel the burn indoors while Mother Nature keeps it cool outside.

Hop to it with a rebounder (a mini trampoline) or a jump rope. If you have neither, fake it by keeping your hands to your sides and rotating them as you mimic the rest of the exercise sans equipment.

Find a YouTube video or other streaming guided workout. Can’t squeeze in a full half hour at once? Pause it and return when you’re ready.

Invest in workout equipment you know you’ll use. If you run or hike, consider a treadmill with an adjustable incline. If you like to ride your bike, consider getting a stationary one.

There are many ways to stay fit when the weather isn’t cooperating. But remember to always discuss any medical concerns with your healthcare provider before beginning any fitness routine; the information provided is not a substitute for medical advice.

Tip adapted from Medical News Today10

Wilhemina Bay, Antarctica

Footnotes And Sources

1.WSJ.com, January 30, 2026

2. Investing.com, January 30, 2026

3.CNBC.com, January 26, 2026

4.CNBC.com, January 27, 2026

5.CNBC.com, January 28, 2026

6.WSJ.com, January 29, 2026

7.CNBC.com, January 30, 2026

8.WSJ.com, January 28, 2026

9.IRS.gov, July 8, 2025

10.Medical News Today, August 25, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2026 FMG Suite.