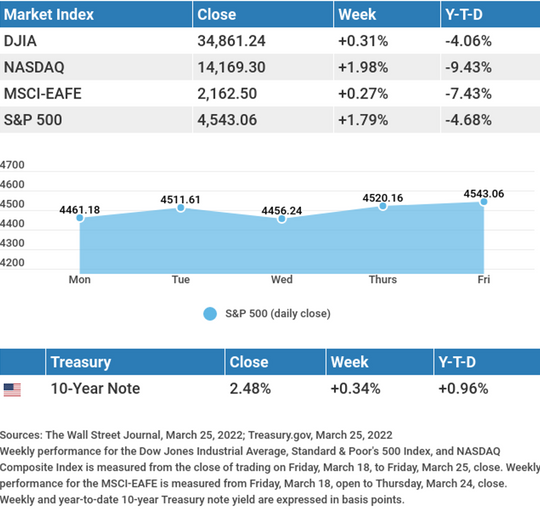

With growing confidence in the economy’s resilience, stocks posted another week of solid gains.

The Dow Jones Industrial Average rose 0.31%, while the Standard & Poor’s 500 advanced 1.79%. The Nasdaq Composite index picked up 1.98% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.27%.1,2,3

Stocks Extend Gains

Markets bounced around all week as investors grappled with the crosswinds of rising yields, continued hostilities in Ukraine, and hawkish comments from Fed Chair Jerome Powell. After suffering declines in two of the first three trading sessions of the week, stocks turned higher on a good jobless claims number that investors interpreted as continuing economic strength.

Stocks drifted higher as the week came to a close amid rising bond yields, which on Friday saw the 10-year Treasury yield rise for the 13th time in 16 trading sessions.4

Labor Market

Many economists speculated that the invasion of Ukraine would likely shave economic growth in the short term as hostilities worsened supply chains and increased inflationary pressures. The impact, so far, has not been seen in the labor market.

Last week’s initial jobless claims fell by 28,000 to 187,000, the lowest level since December 1969. The number of people on state unemployment rolls fell to 1.35 million, from 1.42 million the previous week, while open jobs are at a near-record high of 11.3 million. Employers’ need for workers suggests that the demand for products and services has remained resilient despite the events in Eastern Europe.5

This Week: Key Economic Data

Tuesday: Consumer Confidence. JOLTS (Job Openings and Turnover Survey).

Wednesday: Gross Domestic Product (GDP). Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims.

Friday: Employment Situation. Institute for Supply Management (ISM) Manufacturing Index.

Source: Econoday, March 25, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Micron Technology, Inc. (MU), lululemon athletica, inc. (LULU), Chewy (CHWY).

Wednesday: Paychex, Inc. (PAYX).

Thursday: Walgreens Boots Alliance, Inc. (WBA).

Source: Zacks, March 25, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“The battles that count aren’t the ones for gold medals. The struggles within yourself — the invisible, inevitable battles inside all of us — that’s where it’s at.” – Jesse Owens

Tips for Good Recordkeeping

As you prepare to file your tax return, the first step is to ensure that your records are in order. Good recordkeeping throughout the year will make filing your taxes easier.

Here are some recordkeeping tips:

- Identify all sources of income.

- Keep track of expenses.

- Prepare your tax returns quickly and accurately. Add tax records to your files as you receive them to make filing easier.

- Organize support items that you may need to provide more clarity into your tax return.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Drinking enough water, especially during the summer months, is important to keep you feeling your best. While there aren’t any strict rules on exactly how much water you should drink, you should listen to your body to ensure you’re getting enough.

Here are some tips on how to drink more water throughout the day:

- Keep a reusable water bottle with you. Not only will this save plastic, but it will make it more convenient (and fun) to drink water.

- Set reminders on your phone to drink water, or “anchor” drinking water to other habits throughout your day (ex: at the end of every meeting, drink some water).

- Replace other drinks, such as coffee and soda, with water.

- Drink a glass of water before every meal.

- Flavor your water with fruit or healthy water enhancers.

Tip adapted from Healthline7

New furniture will be delivered to your office on the day before five days from the day after tomorrow. If today is August 18, when will the furniture arrive?

Last week’s riddle: Two lawyers sit at opposite ends of a large conference table. Nothing is in between them but the table, yet they don’t see each other. How is this possible?

Answer: They are both sitting so that their backs are turned to each other.

South Maui beach at sunset, Maui, Hawaii.

Footnotes and Sources

1. The Wall Street Journal, March 25, 2022

2. The Wall Street Journal, March 25, 2022

3. The Wall Street Journal, March 25, 2022

4. The Wall Street Journal, March 25, 2022

5. The Wall Street Journal, March 24, 2022

6. IRS.gov, June 22, 2021

7. Healthline.com, September 30, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.