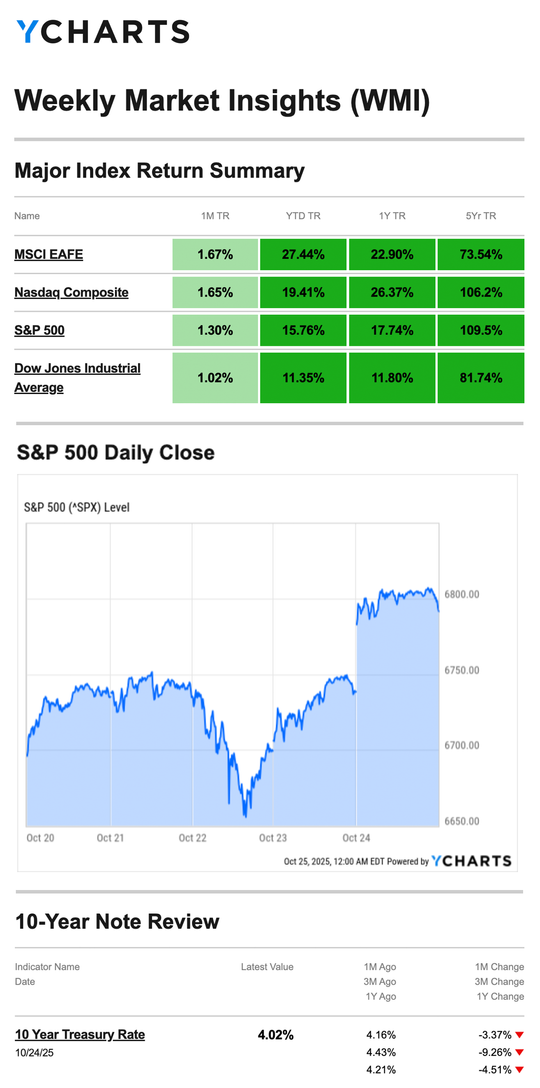

Stocks rose last week thanks to a full slate of upbeat third-quarter corporate results and mild inflation data, which helped soften concerns over trade tensions with China.

The Standard & Poor’s 500 Index gained 1.92 percent, while the Nasdaq Composite Index rose 2.31 percent. The Dow Jones Industrial Average advanced 2.20 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.24 percent.1,2

S&P, Dow Set New Highs on Friday

Stocks rose out of the gate as optimism returned to markets. Strength in the tech sector—and whispers of an imminent end to the government shutdown—pushed all three market averages higher.3

But the strong start turned mixed as some pressure on megacap tech stocks pulled down the Nasdaq. But while tech stocks regrouped, attention shifted to the Dow Industrials, which hit a record intraday high of 47,000 and a record close.4

Sentiment soured midweek as weaker-than-expected earnings results from two megacap tech companies dragged down technology names. Markets came under further pressure following news that the administration was considering restrictions on U.S.-made software exported to China. The S&P, Dow, and Nasdaq all closed lower on Wednesday.5

But the mood brightened Thursday as more megacap tech companies announced strong Q3 results, and as the White House confirmed a scheduled meeting with China.

News on Friday that inflation rose more slowly than expected boosted all three averages. The S&P 500 and Dow Industrials hit all-time intraday and closing highs.6

Source: YCharts.com, October 25, 2025. Weekly performance is measured from Monday, October 20 to Friday, October 24. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Inflation Eases

The Consumer Price Index report, delayed due to the government shutdown, showed prices rose by 3.0 percent in September on an annualized basis, slightly cooler than the 3.1 percent forecast.

This news paved the way for the Fed to stick with its penciled-in rate cut at its two-day meeting, which ends on October 29.

In addition to the upbeat inflation news, Q3 corporate earnings–one of the key drivers of stock prices–have been beating expectations 80% of the time as of Friday.7

This Week: Key Economic Data

Monday: Durable Goods.

Tuesday: Case-Shiller Home Price Index. Consumer Confidence.

Wednesday: Trade Balance in Goods. Retail & Wholesale Inventories. Pending Home Sales. Federal Open Market Committee meeting, Day 2. Fed Interest Rate Decision. Fed Chair Press Conference.

Thursday: Gross Domestic Product (GDP). Weekly Jobless Claims. Fed Official Michelle Bowman speaks.

Friday: Personal Consumption & Expenditures (PCE) Index. Dallas Fed President Logan, Cleveland Fed President Hammack, and Atlantic Fed President Bostic speak.

Source: Investors Business Daily – Econoday economic calendar; October 24, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Welltower Inc. (WELL), Cadence Design Systems, Inc. (CDNS), Waste Management, Inc. (WM)

Tuesday: Visa Inc. (V), United Health Group Incorporated (UNH), NextEra Energy, Inc. (NEE), Booking Holdings Inc. (BKNG), Southern Copper Corporation (SCCO), American Tower Corporation (AMT)

Wednesday: Microsoft Corporation (MSFT), Alphabet Inc. (GOOG/GOOGL), Meta Platforms, Inc. (META), Caterpillar Inc. (CAT), ServiceNow, Inc. (NOW), Verizon Communications Inc. (VZ), The Boeing Company (BA), KLA Corporation (KLAC), Automatic Data Processing, Inc. (ADP), CVS Health Corporation (CVS), Starbucks Corporation (SBUX)

Thursday: Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Eli Lilly and Company (LLY), MasterCard Incorporated (MA), Merck & Co., Inc. (MRK), Gilead Sciences Inc. (GILD), Stryker Corporation (SYK), S&P Global Inc. (SPGI), Comcast Corporation (CMCSA), Altria Group, Inc. (MO), The Southern Company (SO)

Friday: Exxon Mobil Corporation (XOM), AbbVie Inc. (ABBV), Chevron Corporation (CVX)

“Fact creates norms, and truth illumination.”–Werner Herzog

Finding the Goldilocks Tax Withholding

Just like how Goldilocks had to try the porridge that was too hot and then the one that was too cold before she found one that was just right, you need to find the amount of tax withholding that’s not too much or too little for your circumstances. No one wants a nasty surprise when Tax Day comes, and proper withholding can help you manage these surprises.

You should especially check your withholding after a significant life change, such as marriage, divorce, the birth of a child, a move, or changes in tax law.

How much should you withhold? The Tax Withholding Estimator on the IRS website can help determine if you have too much income tax withheld and how to adjust it.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Cut Your Soda Habit With These Alternatives

Are you in the habit of drinking too much soda? Luckily, there are many delicious alternatives to help you cut back. Here are just a few:

- Sparkling water—If you’re after a carbonation fix, there are so many delicious brands and flavors of sparkling water that you’re sure to find one you like.

- Coffee or tea—If you drink soda for the caffeine jolt, try switching to unsweetened coffee or tea instead.

- Fruit—If you have a sweet tooth that only soda can satisfy, try snacking on whole fruits like peaches, mangoes, or berries instead. These fruits have natural sugar.

If you can’t stop drinking soda, try making your own! You can make a healthier version of store-bought soda using a carbonation machine and different flavors of syrups. Generally, these homemade sodas have less sugar and other additives.

Tip adapted from Medical News Today9

Dallas, Texas, United States

Footnotes and Sources

1.WSJ.com, October 24, 2025

2. Investing.com, October 24, 2025

3.CNBC.com, October 20, 2025

4.CNBC.com, October 21, 2025

5.CNBC.com, October 22, 2025

6.WSJ.com, October 24, 2025

7.WSJ.com, October 24, 2025

8. IRS.gov, May 16, 2025

9.Medical News Today, June 11, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.