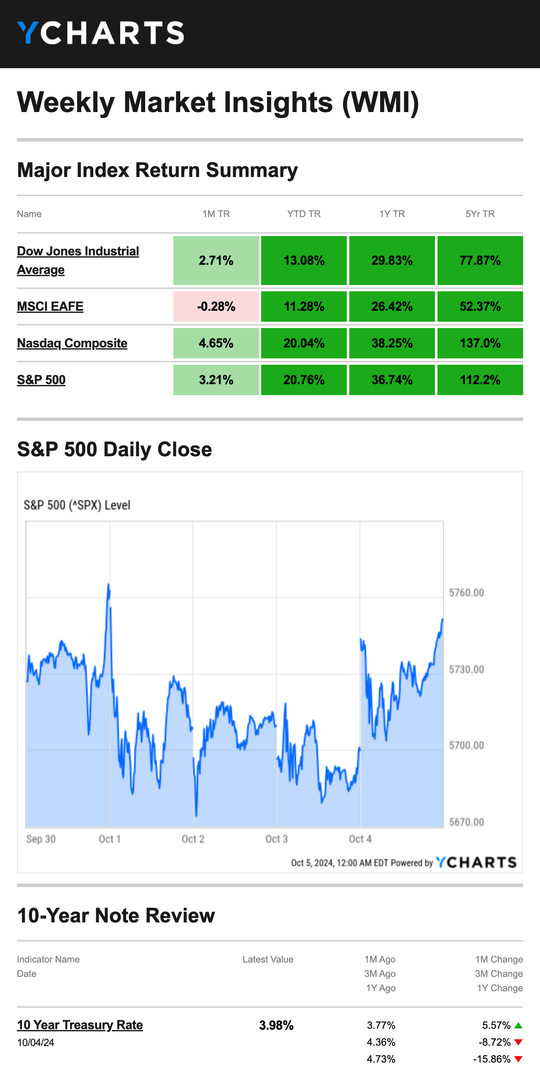

Stocks were essentially unchanged last week as geopolitical tensions added some volatility to an otherwise quiet trading week.

The Dow Jones Industrial Average was flat (+0.09 percent), while the Standard & Poor’s 500 Index ticked up 0.22 percent. The Nasdaq Composite also was flat (+0.10 percent). The MSCI EAFE Index, which tracks developed overseas stock markets, was a bit more unsettled by the geopolitical events, dropping 3.74 percent.1,2

Stocks Flat, Oil Spikes

Stocks posted modest gains on Monday, encouraged by upbeat comments in a speech by Fed Chair Jerome Powell. However, the modest gains pushed the S&P 500 and Dow to fresh records.3

As Middle East tensions escalated on the first day of October, stocks fell, bond yields rose, and oil prices rose as the news unfolded.4

On Wednesday, all three averages were flat. An ADP report showed higher-than-expected private sector job growth—a metric investors focus on. Oil prices continued to rise as investors watched the developments in the Middle East.5,6

Then, on Friday, stocks rallied after the Labor Department’s September jobs report topped expectations.7

Source: YCharts.com, October 5, 2024. Weekly performance is measured from Monday, September 30, to Friday, October 4.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Jobs Out Front

The Labor Department’s jobs report gave investors some much-welcomed insights into the jobs market. At its September meeting, the Fed indicated it was watching the jobs market as closely as inflation, so updates on the jobs market are now considered as important as inflation reports.8

The report showed employers added 254,000 jobs, about 100,000 more than economists expected. It also showed that unemployment ticked down to 4.1 percent last month.9

This Week: Key Economic Data

Monday: Fed Officials Neel Kashkari, Raphael Bostic, and Alberto Musalem speak. Consumer Credit.

Tuesday: International Trade in Goods & Services. Fed Officials Raphael Bostic and Susan Collins speak.

Wednesday: FOMC Minutes. EIA Petroleum Status Report. Fed Officials Raphael Bostic, Lori Logan, Austan Goolsbee, Thomas Barkin, Susan Collins and Mary Daly speak.

Thursday: Consumer Price Index. Weekly Jobless Claims. Fed Balance Sheet. Fed Official John Williams speaks.

Friday: Producer Price Index. Consumer Sentiment. Fed Officials Austan Goolsbee, Lori Logan, and Michelle Bowman speak.

Source: Investors Business Daily – Econoday economic calendar; October 4, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: PepsiCo, Inc. (PEP)

Thursday: Infosys / American Noble Gas Inc. (INFY), Delta Air Lines, Inc. (DAL)

Friday: JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), The Progressive Corporation (PGR), BlackRock, Inc. (BLK), The Bank of New York Mellon Corporation (BK)

Source: Zacks, October 4, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“You can’t judge right from looking at what’s wrong.” – Bo Diddley

Protect Your Financial Safety in Case of a Natural Disaster

No matter where you live, you should be aware of possible natural disasters in your area and plan accordingly by considering the following tax tips:

- Update your emergency plan.

- Create electronic copies of all important documents.

- Document your valuables. Documenting ahead of time makes it easier to claim insurance and tax benefits if a disaster strikes.

- You can call the IRS at 866-562-5227 with any natural disaster-related questions. The agency can provide copies of previous tax returns, order transcripts showing most line items, and more.

- Net personal, casualty, and theft losses may be deductible if attributable to a federally declared disaster.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

The Scale Isn’t Everything: More-Comprehensive Ways to Measure Your Health

Put the scale away for a little while and try these techniques to focus on your overall health rather than just a number:

- Keep a journal and track your healthy habits, such as working out or eating veggies with every meal. Celebrate these small victories!

- Take progress photos and compare them throughout your journey. Take your pictures in the same pose, wearing the same outfit, at the same time every week (preferably in the morning before you’ve had breakfast).

- Check on other aspects of your health, such as your energy levels, skin, and tummy health. Developing a healthy routine does much more for your body than just lowering the number on the scale.

These are just a few ways to check in with yourself on your fitness and wellness journey without the scale.

Tip adapted from Daily Burn11

Hot springs, Dallol, Danakil Depression, Afar Region

Ethiopia, Africa

Footnotes and Sources

1. The Wall Street Journal, October 4, 2024

2. Investing.com, October 4, 2024

3. CNBC.com, September 30, 2024

4. The Wall Street Journal, October 1, 2024

5. The Wall Street Journal, October 2, 2024

6. The Financial Times, October 3, 2024

7. The Wall Street Journal, October 4, 2024

8. The Wall Street Journal, October 2, 2024

9. The Wall Street Journal, October 4, 2024

10. IRS.gov, July 24, 2024

11. Daily Burn, July 24, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.