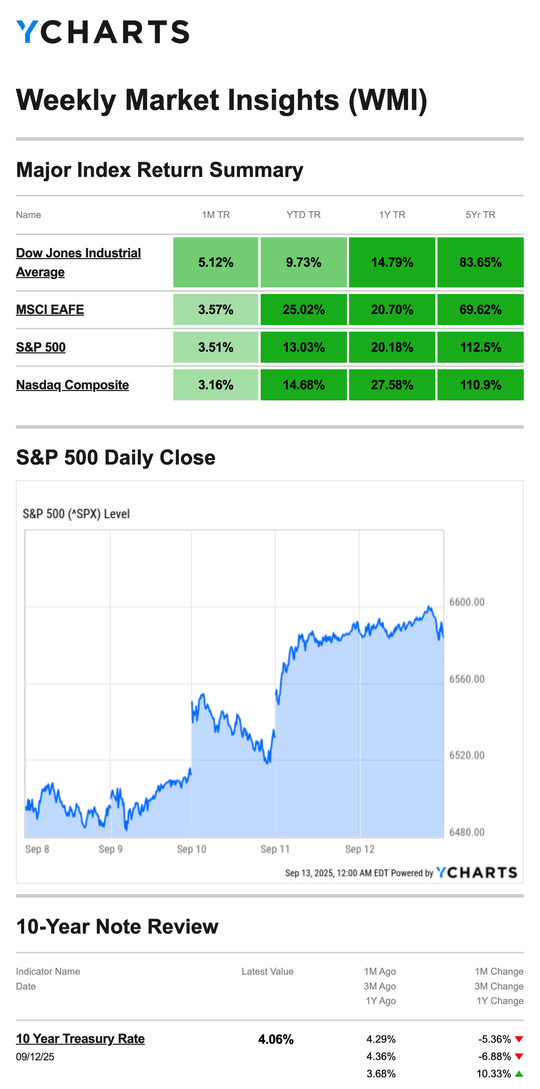

Stocks posted a solid gain last week, riding a rally in megacap tech stocks while overcoming interest rate anxiety, a downward revision to jobs data, and mixed inflation reports.

The Standard & Poor’s 500 Index rose 1.59 percent, while the Nasdaq Composite Index climbed 2.03 percent. The Dow Jones Industrial Average added 0.95 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 1.18 percent.1,2

Stocks At New Highs

Stocks rose to start the week on renewed AI enthusiasm, with the Nasdaq hitting a new record intraday high. Stocks continued to push ahead on Tuesday despite fresh data showing large downward revisions to job creation for the 12 months through March.3

The rally continued midweek after an unexpected drop in wholesale inflation appeared to boost investors’ hopes for Fed rate moves before the year’s end.4,5

Investors cheered Thursday’s consumer inflation report, anticipating that the reading wouldn’t be enough to derail a Fed rate move this month. The S&P and Nasdaq posted record intraday highs and closes three days in a row, while the Dow Industrials cracked 46,000 for the first time.6

The Nasdaq hit a new record close on Friday, while the S&P 500 flattened out and the Dow posted a modest loss on the week’s last day of trading.7

Source: YCharts.com, September 13, 2025. Weekly performance is measured from Friday, September 8, to Friday, September 12. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Fed Meets After Mixed Inflation Reports

Wednesday’s Producer Price Index (PPI) report showed wholesale prices fell 0.1 percent in August after a 0.7 percent increase in July. Then, on Thursday, fresh Consumer Price Index (CPI) data showed that retail prices rose a hotter-than-expected 0.4 percent in August—faster than July’s 0.3 percent gain.8,9

All eyes will be on Fed Chair Powell this week. He is expected to outline his plan to adjust rates at the Fed’s scheduled two-day meeting, which ends on Wednesday, September 17. Investors will be looking for insights about how he plans to guide the economy through this period of sluggish job growth and stubborn consumer inflation.

This Week: Key Economic Data

Tuesday: Retail Sales. Import Price Index. Industrial Production. Business Inventories. Home Builder Confidence Index.

Wednesday: Housing Starts. Building Permits. Federal Reserve Interest Rate Decision. Fed Chair Powell Press Conference.

Thursday: Weekly Jobless Claims. Leading Economic Indicators.

Source: Investors Business Daily – Econoday economic calendar; September 12, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: General Mills, Inc. (GIS)

Thursday: FedEx Corporation (FDX)

Source: Zacks, September 12, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“In times of rapid change, experience could be your worst enemy.” –J. Paul Getty

Tax Benefit and Credits: FAQs for Retirees

Lots of questions can come up about income taxes after one has retired. Some common types of taxable income include military retirement pay, all or part of pensions and annuities, all or part of individual retirement accounts (IRA), unemployment compensation, gambling income, bonuses and awards for outstanding work, and alimony or prizes. A few examples of non-taxable income are veteran’s benefits, disability pay for certain military or government-related incidents, worker’s compensation, and cash rebates from a dealer or manufacturer of an item you purchased.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Tips for Checking Your Blood Pressure at Home

Checking your blood pressure regularly is a great step to take to monitor your health, especially if you or someone in your family is prone to high blood pressure and hypertension.

In order to check your blood pressure at home, you will need a blood pressure monitor. Most at-home blood pressure monitors today have a digital screen, but some have a manual screen. No matter which one you have, here are some tips to keep in mind:

- Position the cuff about 1 inch above the bend of your elbow. Your monitor might have an arrow of which way it should point, but generally the stethoscope head/inflator should be over the artery on the inside of your arm.

- Allow the cuff to completely deflate before reading the results.

- Keep your arm straight.

- If the results aren’t accurate the first time, wait at least a minute before applying the cuff again.

Tip adapted fromWebMD11

Ruins of Machu Picchu

Machu Picchu, Cusco Province, Peru

Footnotes and Sources

1.WSJ.com, September 12, 2025

2. Investing.com, September 12, 2025

3.WSJ.com, September 8, 2025

4.CNBC.com, September 9, 2025

5.WSJ.com, September 10, 2025

6.CNBC.com, September 11, 2025

7.CNBC.com, September 12, 2025

8.WSJ.com, September 10, 2025

9.WSJ.com, September 11, 2025

10. IRS.gov, March 30, 2025

11.WebMD, March 20, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.