In this week’s recap: Mixed signals lead to a choppy week.

THE WEEK ON WALL STREET

The crosscurrents of strong corporate earnings, rising global cases of COVID-19, and the specter of higher capital gains taxes led to a choppy week of trading that left stock prices slightly lower for the week.

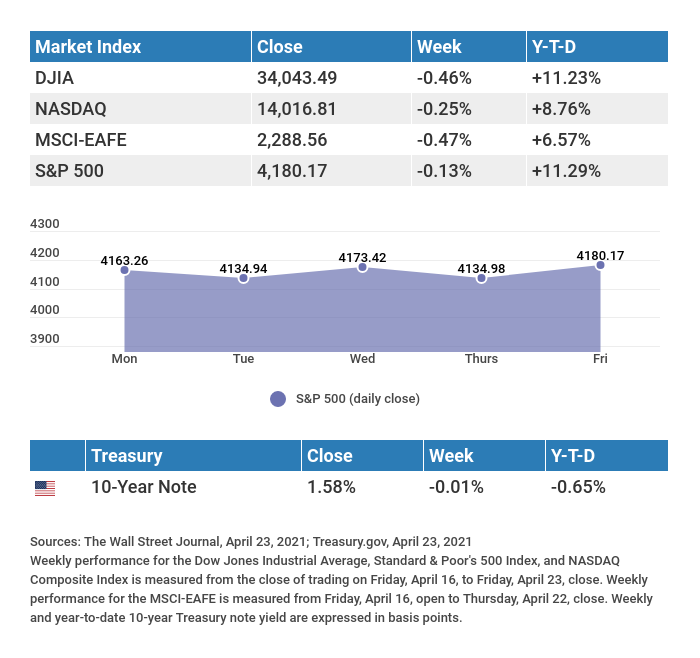

The Dow Jones Industrial Average lost 0.46%, while the Standard & Poor’s 500 slipped 0.13%. The Nasdaq Composite index fell 0.25% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 0.47%.1,2,3

A Directionless Week

Despite continued better-than-expected corporate earnings, stocks retreated as concerns over rising global COVID-19 infections weighed on investor sentiment. A mid-week rally erased much of these losses, with reopening stocks and small cap companies leading the market.

The stock market resumed its decline in reaction to reports that President Biden supported a capital gains tax increase on wealthy Americans. The Biden news prompted worries that stocks could come under pressure this year if such an increase were to go into effect next year.

Solid economic reports, along with a reassessment of the capital gains news, helped stocks to bounce back and close out the week on a positive note.

Housing Shows Strength

Two housing market reports last week reflected strong consumer demand for homes.

Sales of new homes in March jumped by 20.7% from February and by more than 66% from last March, reaching levels not seen since 2006. All regions recorded double-digit gains, except for the West, which experienced a decline of 30%.4

Though existing home sales fell 3.7%, it wasn’t for lack of consumer interest, as evidenced by the 18-day average to sell a home. The decline was largely an issue of tight inventories. This demand/supply imbalance drove median home prices higher by 17.2% from March 2020 to $329,100.5

TIP OF THE WEEK

Save your business money by buying furnishings and equipment at bankruptcy auctions, government sales, closeouts and furniture rental outlets.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Durable Goods Orders.

Tuesday: Consumer Confidence.

Wednesday: Federal Open Market Committee (FOMC) Announcement.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Source: Econoday, April 23, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Tesla, Inc. (TSLA).

Tuesday: Microsoft (MSFT), Advanced Micro Devices, Inc. (AMD), Visa (V), Alphabet, Inc. (GOOGL), Starbucks (SBUX), Amgen, Inc. (AMGN), Eli Lilly and Company (LLY), 3M Company (MMM), Texas Instruments (TXN), United Parcel Service (UPS), Mondelez International (MDLZ).

Wednesday: Apple, Inc. (AAPL), Facebook (FB), Boeing (BA), Ford Motor Company (F), Qualcomm (QCOM), Shopify, Inc. (SHOP), Servicenow, Inc. (NOW), Teladoc Health, Inc. (TDOC), Ebay (EBAY).

Thursday: Amazon.com (AMZN), Twitter, Inc. (TWTR), Mastercard (MA), Bristol Myers Squibb (BMY), Caterpillar, Inc. (CAT), Merck & Company (MRK), McDonald’s Corporation (MCD), Comcast Corporation (CMCSA), American Tower Corporation (AMT).

Friday: Abbvie, Inc (ABBV), Chevron (CVX), Charter Communications (CHTR).

Source: Zacks, April 23, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Optimism is the faith that leads to achievement.” – HELEN KELLER

THE WEEKLY RIDDLE

A certain month can begin on a Friday and end on a Friday as well. What month is it?

LAST WEEK’S RIDDLE:

What number is 4 more than the number that is double one-fifth of one-tenth of 900?

ANSWER:

40 (900 / 10 = 90 / 5 = 18 x 2 = 36 + 4 = 40).

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and

principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original

cost.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This

information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee

of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is

advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may

not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any

investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any

particular investment.

Securities offered through Fortune Financial Services, Inc. Santiago Orchard Financial & Insurance and Fortune Financial Services are separate

entities. Member FINRA / SIPC

3582 Brodhead Road Suite 202 Monaca, PA 15061 724-846-2488

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and

principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original

cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not

indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals

cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the

U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and is considered

a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital

International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI

indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to

be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury

Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including

changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks

unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price

volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or

legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and

produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial

1. The Wall Street Journal, April 23, 2021.

2. The Wall Street Journal, April 23, 2021

3. The Wall Street Journal, April 23, 2021

4. Yahoo! News, April 23, 2021

5. CNBC, April 22, 2021