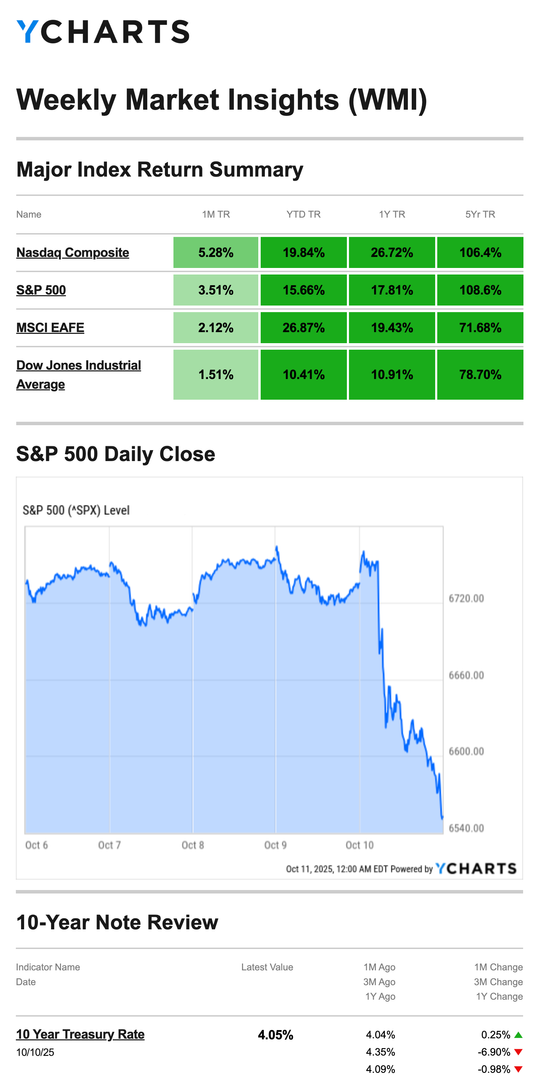

Stocks fell last week amid concerns about trade with China, following an unsteady rally to record highs over the first half of the week.

The Standard & Poor’s 500 Index fell 2.43 percent, while the Nasdaq Composite Index declined 2.53 percent. The Dow Jones Industrial Average slid 2.73 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 1.64 percent.1,2

Stocks Set Highs Before Friday’s Drop

Stocks began the week mostly positive. However, Monday marked Day 6 of the government shutdown, and two of the three major averages powered through any bearish sentiment. The S&P 500 and the Nasdaq each advanced to record closes on fresh enthusiasm for mergers & acquisitions activity after the announcement of two deals. By contrast, the Dow fell slightly.3,4

Stocks pushed higher midweek as investors looked past the Fed meeting minutes from September, which revealed somewhat divided opinions on interest rates. The S&P and Nasdaq both closed at record highs.4

On Friday, sentiment turned negative a little over an hour into the trading session after the White House announced a tariff increase on imported goods from China. The decline, led by chip manufacturers, erased the week’s gains. It was the largest single-day decline for stocks since April.5,6,7

Source: YCharts.com, October 11, 2025. Weekly performance is measured from Monday, October 6 to Friday, October 10. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

China In Focus

Meanwhile, focus turned to new export controls that China imposed on so called rare earth metals—key ingredients for AI-powered microchips and vital resources for the defense industry. Investor concern centered mostly around AI chip companies, which have exposure to China both as customers and in terms of manufacturing.8

The White House threatened to cancel its upcoming meeting with the Chinese president over the dispute. China controls approximately 70 percent of the global supply of rare earth metals, meaning a policy change can impact markets.8

Separately, the government shutdown entered its second week. Shutdowns typically don’t heavily impact markets, but the uncertainty continues to hang over trading.9

This Week: Key Economic Data

Monday: Philadelphia Fed President Anna Paulson speaks.

Tuesday: Small Business (NFIB) Optimism Index. Fed governors Michelle Bowman and Christopher Waller, and Boston Fed President Susan Collins speak.

Wednesday: Atlanta Fed President Raphael Bostic, and Fed governors Stephen Miran and Christopher Waller speak. Fed Beige Book.

Thursday: Retail Sales. Producer Price Index (PPI). Weekly Jobless Claims. Business Inventories. Home Builder Confidence Index. Richmond Fed President Tom Barkin, and Fed governors Michelle Bowman, Stephen Miran, and Christopher Waller speak.

Friday: Housing Starts. Building Permits. Import Prices. Industrial Production. Capacity Utilization.

Source: Investors Business Daily – Econoday economic calendar; October 10, 2025.

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: JPMorgan Chase & Co. (JPM), Johnson & Johnson (JNJ), Wells Fargo & Company (WFC), The Goldman Sachs Group, Inc. (GS), BlackRock (BLK), Citigroup Inc. (C)

Wednesday: Bank of America Corporation (BAC), Morgan Stanley (MS), Abbott Laboratories (ABT), The Progressive Corporation (PGR), Prologis, Inc. (PLD), The PNC Financial Services Group, Inc. (PNC)

Thursday: The Charles Schwab Corporation (SCHW), Intuitive Surgical, Inc. (ISRG), Interactive Brokers Group, Inc. (IBKR), Marsh & McLennan Companies, Inc. (MMC)

Friday: American Express Company (AXP)

Source: Zacks, October 10, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”–Winston Churchill

Is an Offer in Compromise Too Good to be True?

An Offer in Compromise is an agreement between a taxpayer and the IRS that settles a tax debt for less than the total amount owed; this is a genuine service offered by the IRS. The problem arises when “OIC mills” promise things they can’t do.

These OIC mills encourage people to hire their company to file an OIC application, even though the taxpayer may not qualify. They often charge significant fees and waste your time and money.

Taxpayers who qualify for an OIC can get the same deal working directly with the IRS without the extra fees. Before hiring a company to file an OIC on your behalf, check the IRS website to see if you pre-qualify for an OIC. The site also provides resources to help you understand the process.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Create a Morning Routine That You Love

The first hour of your morning can dictate your productivity for the rest of the day, so it’s worth investing in a morning routine you love. How do some of the most successful people spend the first few hours of their day? Here are a few tips:

- Don’t check your email for the first hour of your workday.

- Take a moment to reflect on the things you’re grateful for; this will help set a positive tone for your day.

- Mark Twain famously said that if you eat a live frog first thing in the morning, you’ve got it behind you for the rest of your day. Consider doing your most challenging work first thing in the morning.

- Engage in some gentle movement, such as going for a walk, stretching, or practicing yoga.

What are some of your favorite morning rituals?

Tip adapted from Fast Company11

Antarctic seals

South Georgia Island, Antarctica

Footnotes and Sources

1.WSJ.com, October 10, 2025

2. Investing.com, October 10, 2025

3.CNBC.com, October 6, 2025

4.CNBC.com, October 8, 2025

5.CNBC.com, October 9, 2025

6.WSJ.com, October 10, 2025

7.WSJ.com, October 10, 2025

8.WSJ.com, October 10, 2025

9.WSJ.com, October 9, 2025

10. IRS.gov, May 22, 2025

11.Fast Company, June 11, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite