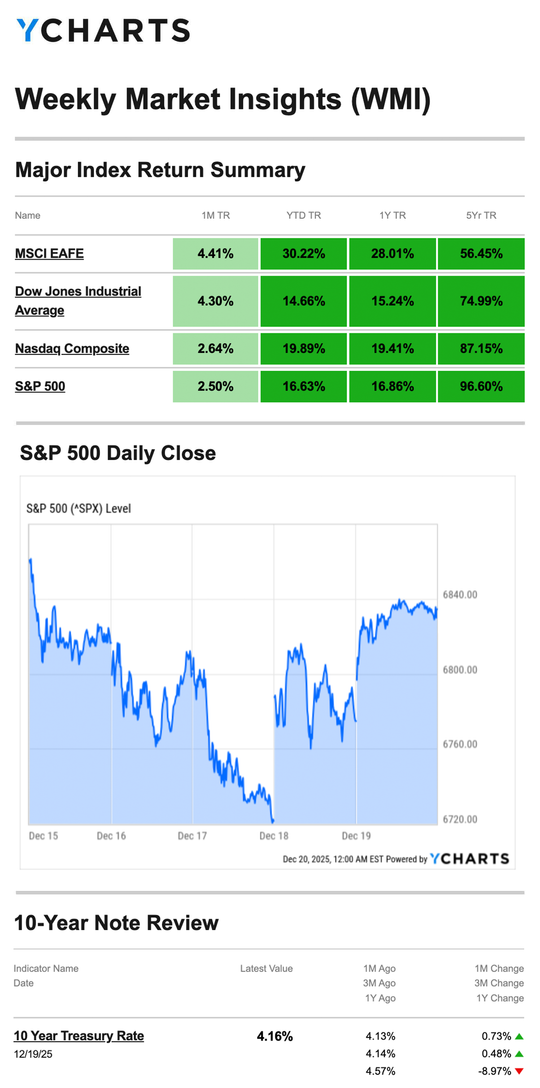

Stocks posted a slight gain last week as mixed jobs data triggered some selling pressure before a cooling inflation report helped stocks recover.

The Standard & Poor’s 500 Index inched ahead 0.10 percent, while the Nasdaq Composite Index advanced 0.48 percent. The Dow Jones Industrial Average slipped 0.67 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 0.21 percent.1,2

Round Trip for Stocks

A mixed jobs report on Tuesday created some concerns about the economy, leading the S&P 500 and Dow Industrials to modest declines. However, the tech-heavy Nasdaq posted a modest gain.3,4

Stocks continued their retreat on Wednesday with a handful of AI-related names leading the decline.5

Markets then staged a rebound as a fresh inflation report came in cooler than expected for November, raising investor hopes that interest rates may trend lower. The S&P 500 and Dow Industrials broke four-day losing streaks, while the Nasdaq rebounded 1.4 percent on Thursday alone.6

Megacap tech stocks rebounded on the last trading day of the week, lifting the broader market. Investors appeared to look past a disappointing report on consumer sentiment.7

Source: YCharts.com, December 20, 2025. Weekly performance is measured from Monday, December 15, to Friday, December 19. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Push & Pull of Jobs & Inflation

The Bureau of Labor Statistics combined its October and November employment data into one report. However, the October report only contained partial data due to the shutdown, while the November numbers reflected full data.

While November saw an unexpected increase (+64,000 versus economist expectations of +45,000), the October report showed employers cut 105,000 jobs. The unemployment rate ticked up to 4.6 percent.8

The Consumer Price Index’s (CPI) 2.7 percent year-over-year pace for November was slower than the 3.1 percent economists expected, and slower than September’s 3.0 percent pace. Market gains were tempered, however, as economists cautioned that shutdown-related gaps may have influenced some of the data.9

This Week: Key Economic Data

Tuesday: Gross Domestic Product (GDP)*, Q3. Durable Goods* (Oct). Consumer Confidence. New Home Sales, Sept.* Industrial Production, Oct.*

Wednesday: Weekly Jobless Claims. Survey of Business Uncertainty.

Thursday: CHRISTMAS HOLIDAY—MARKETS CLOSED

*indicates publication of a report delayed by the government shutdown in October and November

Source: Investors Business Daily – Econoday economic calendar; December 19, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

No major companies are reporting earnings this week.

Source: Zacks, December 19, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your goals, time horizon, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule their earnings reports without notice.

“Our destiny is in our hands […] So let’s build the future we all know is possible. Let’s prove to our children that they really can reach for their dreams.” –Michelle Obama

What is the IRS Alternative Media Center?

The IRS Alternative Media Center offers a variety of resources and accessibility services for visually impaired taxpayers. Using this platform, they provide tax-related content in several formats, including:

- Text-only

- Braille-ready files (available in English and Spanish)

- Browser-friendly HTML

- Accessible PDF (available in English and Spanish)

- Large print PDF (available in a variety of languages)

The IRS also offers enhanced accessibility services. Taxpayers can complete Form 9000, Alternative Media Preference, to choose how they would prefer to receive their tax notices (ex: in Braille, large print, audio, or electronic formats). They also have an accessibility helpline that can answer questions related to accessibility services.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov10

Controlling Different Kinds of Light to Help You Sleep Better

Controlling your environment, including your exposure to light, may help you sleep better at night.

Increase your exposure to bright light during the day.

We know it’s beneficial to keep your room dark while you sleep, but it’s also helpful to get more bright light throughout the day! This contrast may help reset your circadian rhythm.

Reduce blue light exposure at least an hour before bed.

Blue light may make it difficult for our brains to relax and fall asleep. Because of this, some sleep experts recommend limiting blue light at least an hour before bedtime. You can also turn “night mode” on, giving your device screens a gentler yellowish hue than blue light.

Tip adapted from WebMD11

Le Cascate del Mulino, Tuscany, Italy

Tuscany, Italy

Footnotes and Sources

1.WSJ.com, December 19, 2025

2. Investing.com, December 19, 2025

3.CNBC.com, December 16, 2025

4.WSJ.com, December 16, 2025

5.CNBC.com, December 17, 2025

6.WSJ.com, December 18, 2025

7.CNBC.com, December 19, 2025

8.WSJ.com, December 16, 2025

9.WSJ.com, December 18, 2025

10. IRS.gov, January 22, 2025

11.WebMD.com, June 16, 2025

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.