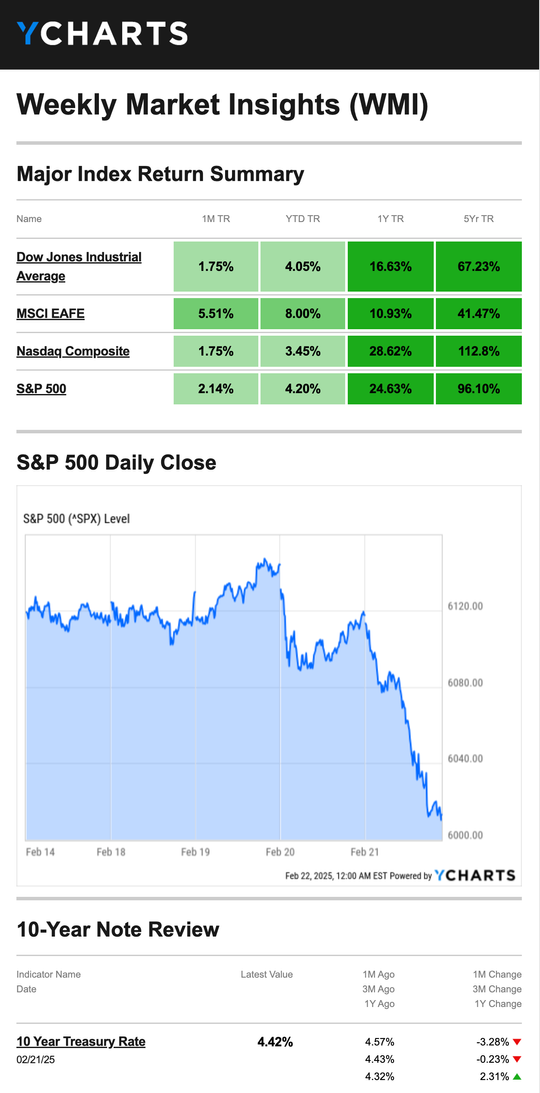

Stocks fell last week as concerns about sticky inflation and the pace of economic growth rattled investors.

The Standard & Poor’s 500 Index declined 1.66 percent, while the Nasdaq Composite Index dropped 2.51 percent. The Dow Jones Industrial Average also fell 2.51 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was essentially flat (+0.04 percent).1,2

S&P 500 Hits New High, Then Slips

Following the Presidents’ Day holiday, stock prices were largely range bound on Tuesday despite some intraday volatility. Then stocks edged higher, shaking off some new tariff talk and disappointing housing starts data. The S&P 500 marked its third record close of the year on Wednesday.3,4

On Thursday, stocks were under pressure from the start of trading after a weaker-than-expected outlook from a mega-retailer. The update reinforced some concerns that the economy may be slowing. The selling accelerated on Friday after a consumer sentiment survey showed investors are unsettled about the inflation outlook.

Friday’s decline was the worst of the young year.5

Source: YCharts.com, February 22, 2025. Weekly performance is measured from Friday, February 14, to Friday, February 21. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Economic Jitters

Investors were forced to navigate a week of disappointing news about the economy and inflation.

First, traders were surprised to hear about slowing demand at the country’s biggest retailer, which soured the outlook for the consumer and the economy. Then, the University of Michigan Consumer Confidence survey fell by 10 percent in February as consumers expressed concerns about higher inflation ahead of possible new tariffs.6

This combination prompted investors to move into a “risk-off” position before the weekend.

This Week: Key Economic Data

Tuesday: Consumer Confidence. Fed Officials Lorie Logan and Thomas Barkin speak.

Wednesday: New Home Sales. Fed Officials Thomas Barkin and Raphael Bostic speak.

Thursday: Gross Domestic Product (GDP). Durable Goods. Weekly Jobless Claims. Pending Home Sales. Fed Balance Sheet.

Friday: Personal Consumption and Expenditures (PCE) Index.

Source: Investors Business Daily – Econoday economic calendar; February 21, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Home Depot, Inc. (HD), Intuit Inc. (INTU)

Wednesday: NVIDIA Corporation (NVDA), Salesforce Inc. (CRM), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX)

Thursday: Dell Technologies Inc. (DELL)

Friday: Berkshire Hathaway Inc. (BRK.A,BRK.B)

Source: Zacks, February 21, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“One man practicing sportsmanship is far better than 50 preaching it.” –Knute Rockne

Receive Your Tax Return Quicker With Direct Deposit

Want to receive your tax return quickly? The IRS recommends filing your return online and providing your direct deposit information. In addition to receiving your refund quicker, using direct deposit has a few other benefits.

Direct deposit is also fast, secure, and accessible. You must provide your bank account and routing number to sign up for direct deposit. Taxpayers should have this information available when ready to file because the IRS can’t accept it after filing a return.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

How to Start a Meditation Practice

If you’re interested in starting a meditation practice, the good news is that you don’t need much to get started. Here are some tips:

- First, find a place to meditate. It doesn’t have to be a dedicated space but should be calming and free from distractions.

- Next, set a time limit. Even just 5 minutes of meditation a day is enough to get started.

- Now, it’s time for the actual meditation! Meditation aims to clear your mind of intrusive thoughts and be fully present where you are. Don’t focus on not thinking about anything at all. Instead, watch your thoughts float by as you stay centered on your breath.

- If your mind wanders, it’s okay! Gently bring it back to the present and focus on your breath or something around you.

Tip adapted from Mindful8

Shanghai at Night

Shanghai, China

Footnotes and Sources

1.The Wall Street Journal, February 21, 2025

2. Investing.com, February 21, 2025

3.CNBC.com, February 18, 2025

4.The Wall Street Journal, February 19, 2025

5.CNBC.com, February 21, 2025

6.The Wall Street Journal, February 21, 2025

7.IRS.gov, April 11, 2024

8.Mindful, October 3, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.