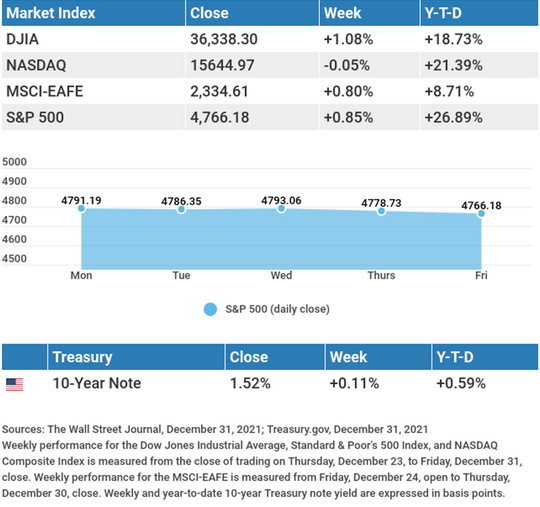

Stocks closed out the year on a mostly positive note, adding to the year’s gains as concerns about the economic issues of Omicron infections receded.

The Dow Jones Industrial Average rose 1.08%, while the Standard & Poor’s 500 picked up 0.85%. The Nasdaq Composite index was flat (-0.05%) for the week. The MSCI EAFE index, which tracks developed overseas stock markets, posted an increase of 0.80%.1,2,3

Stocks Notch Record Highs

The end of the year is historically a strong period for stocks–a seasonal pattern dubbed “The Santa Claus Rally.” This year’s final week of trading did not disappoint as stocks posted healthy gains to kick off the week, despite a global increase in Omicron infections. Investors were buoyed by data that showed fewer associated hospitalizations, which helped ease fears of the variant’s economic impact.

The S&P 500 set multiple fresh record highs, with Wednesday’s new high representing the 70th such high in 2021, while the Dow Industrials recorded its first new record since November. Stocks drifted on low trading volume in the final two trading days of the year, capping a good week, a solid month, and a strong year for investors.4

Robust Holiday Sales

The market got off to a good start last week in part due to a strong holiday sales report. A major credit card issuer reported that consumer holiday spending rose 8.5% from last year’s levels, driven by an 11.0% gain in online sales. It was the biggest annual increase in 17 years. The spending by consumers exceeded pre-pandemic sales by 10.7%. The retail categories that experienced the highest sales increases were apparel (+47.3%) and jewelry (+32.0%).5

It was a particularly robust number in view of investor concerns about supply chain disruptions, port congestion, labor shortages, and wavering consumer confidence.

This Week: Key Economic Data

Tuesday: JOLTS (Job Openings and Turnover Survey). Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI).

Thursday: Jobless Claims. Factory Orders. Institute for Supply Management (ISM) Non- Manufacturing Purchasing Managers’ Index (PMI).

Friday: Employment Situation.

Source: Econoday, December 31, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Thursday: Constellation Brands, Inc. (STZ), Walgreens Boots Alliance, Inc. (WBA), Conagra Brands (CAG).

Source: Zacks, December 31, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“It is not the position, but the disposition.” – Susan Sontag

Military Members and Their Families Can Receive Free Tax Advice

The IRS started the Volunteer Income Tax Assistance (VITA) program to provide free tax advice, preparation, return filing help, and other assistance to military members and their families. This also includes specific tax advice for military members on topics such as combat zone tax benefits, special extensions, and other special rules. VITA has convenient locations on and off base and even has offices overseas.

These offerings are just one way the IRS is striving to make tax information available to all. It also offers other free assistance programs to taxpayers who qualify, including the elderly, through its Tax Counseling for the Elderly (TCE) program.

* This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from militaryonesource.mil6

Indoor Exercises to Stay Active

During the winter, it might be hard to get outside often for walks and exercise, but there are plenty of exercises you can do indoors, even when the weather outside is not cooperating. Here are some simple moves to get you exercising indoors:

- Start with your core. Do 30 crunches followed by a minute-long plank. Repeat for three sets.

- Do two sets of mountain climbers: 60 seconds on, 30 seconds of rest.

- Do push-ups (either on your knees or on your toes), and on your last rep, hold a plank for a minute. Rest for 20 seconds, then repeat three more times.

- Do a standing, reverse lunge, 20 reps on each side. Complete three sets.

- Do regular squats, but hold at the lowest point for three seconds.

Complete 20 reps three times.

Tip adapted from Active7

I was framed, yet the man who framed me committed no crime. How is this possible?

Last week’s riddle: Tim hands a friend $63 using six bills, none of which are dollar bills. How is he able to do this?

Answer: One $50 bill, one $5 bill, and four $2 bills.

Seaside wooden tree house on the island of Nusa Penida, Bali, Indonesia.

Footnotes and Sources

1. The Wall Street Journal, December 31, 2021

2. The Wall Street Journal, December 31, 2021

3. The Wall Street Journal, December 31, 2021

4. CNBC, December 29, 2021

5. CNBC, December 27, 2021

6. militaryonesource.mil, June 1, 2021

7. Active, June 24, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2022 FMG Suite.