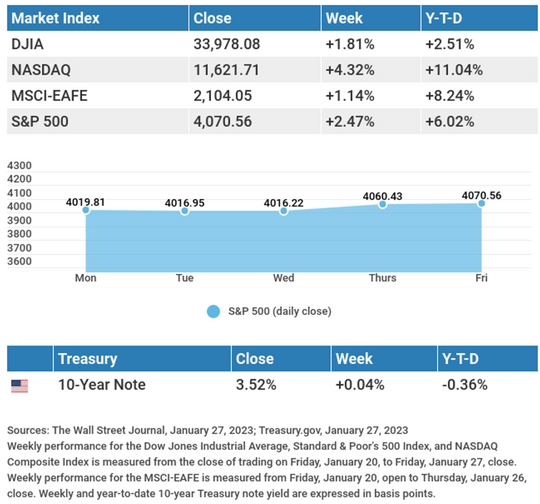

Stocks added to their early 2023 gains amid a busy stream of mixed corporate earnings results and conflicting economic data.

The Dow Jones Industrial Average gained 1.81%, while the Standard & Poor’s 500 added 2.47%. The Nasdaq Composite index rose 4.32% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, increased by 1.14%.1,2,3

Stocks Advance

With the backdrop of earnings reports and conflicting economic data, stocks climbed higher on cooling inflation, continued economic resilience, and fourth-quarter corporate earnings results that, while underwhelming, did not appear as bad as many had feared.

There was enough new economic data to support both the “recession is coming” and the “soft landing” camps. It was corporate results and continued labor market strength, along with a solid, if weakening, fourthquarter Gross Domestic Product (GDP) growth number, however, that raised investors’ hopes that a potential recession may be mild and likely pushed out to later in the year.

GDP Report

The U.S. economy expanded at a 2.9% annualized rate in the fourth quarter, slightly exceeding consensus estimates of 2.8% but down from the third quarter’s 3.2% growth rate. Consumer spending, which accounts for over two-thirds of GDP, rose 2.1%. Increases in private inventory investment, government spending, and nonresidential fixed investment also contributed to the fourth quarter’s growth. Weakness in housing and a drop in exports subtracted from the quarter’s result.4

Beneath the headline number, the personal consumption expenditures price index (the Fed’s preferred measure of inflation) rose 3.2%. That was lower than the third quarter’s 4.8% increase, though it remains above the Fed’s 2% inflation target rate.5

This Week: Key Economic Data

Wednesday: Federal Open Market Committee Announcement. Job Openings and Turnover Survey (JOLTS). Institute for Supply Management (ISM) Manufacturing Index. Automated Data Processing (ADP) Employment Report.

Thursday: Factory Orders. Jobless Claims.

Friday: Employment Situation. Institute for Supply Management (ISM) Services Index.

Source: Econoday, January 27, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Principal Financial Group, Inc. (PFG).

Tuesday: Advanced Micro Devices, Inc. (AMD), Pfizer, Inc. (PFE), Caterpillar, Inc. (CAT), General Motors Company (GM), McDonald’s Corporation (MCD), Amgen, Inc. (AMGN), United Parcel Service, Inc. (UPS), Stryker Corporation (SYK).

Wednesday: Thermo Fisher Scientific, Inc. (TMO), Humana, Inc. (HUM), TMobile US, Inc. (TMUS).

Thursday: Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), Ford Motor Company (F), Alphabet, Inc. (GOOGL), Qualcomm, Inc. (QCOM), Bristol Myers Squibb Company (BMY), Merck & Co., Inc. (MRK), Eli Lilly and Company (LLY), Honeywell International, Inc. (HON).

Friday: Cigna Corporation(CI), Regeneron Pharmaceuticals, Inc. (REGN).

Source: Zacks, January 27, 2023

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“Fact creates norms, and truth illumination.” – Werner Herzog

Finding the Goldilocks Tax Withholding

Just like how Goldilocks had to try the porridge that was too hot and then the one that was too cold before she found one that was just right, you need to find the amount of tax withholding that’s not too much or too little for your circumstances. No one wants a bad surprise when Tax Day comes, and having the proper withholding can help you avoid these surprises.

You should especially check your withholding after a significant life change, such as a marriage, divorce, new child, a move, or major changes in the tax law.

How much should you withhold? The Tax Withholding Estimator on the IRS website can help people determine if they have too much income tax withheld and how to adjust.

Tip adapted from IRS.gov6

Cut Your Soda Habit With These Alternatives

Are you in the habit of drinking too much soda? Luckily, there are a lot of delicious alternatives to help you cut back. Here are just a few:

- Sparkling water – If you’re after a carbonation fix, there are so many delicious brands and flavors of sparkling water, you’re sure to find one you like.

- Coffee or tea – If you drink soda for the caffeine jolt, try switching to unsweetened coffee or tea instead.

- Fruit – If you have a sweet tooth that only soda can satisfy, try snacking on whole fruits like peaches, mangoes, or berries instead. These fruits have natural sugar.

If you can’t stop drinking soda, try making your own! You can make a healthier version of store-bought soda using a carbonation machine and different flavors of syrups. Generally, these homemade sodas have less sugar and other additives.

Tip adapted from Medical News Today7

Beaver Creek, Colorado

Footnotes and Sources

1. The Wall Street Journal, January 27, 2023

2. The Wall Street Journal, January 27, 2023

3. The Wall Street Journal, January 27, 2023

4. CNBC, January 26, 2023

5. CNBC, January 26, 2023

6. IRS.gov, November 2, 2022

7. Medical News Today, February 18, 2021

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2023 FMG Suite.