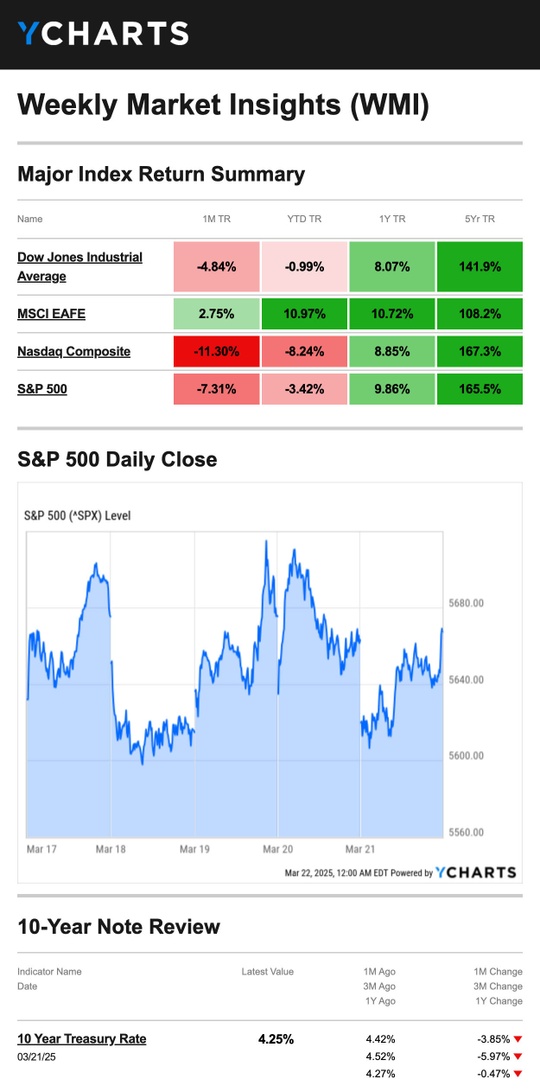

Stocks notched a solid gain last week as upbeat comments from the Fed helped stocks snap their four-week losing streak.

The Standard & Poor’s 500 Index rose 0.51 percent, while the Nasdaq Composite Index picked up 0.17 percent. The Dow Jones Industrial Average led, gaining 1.20 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 0.75 percent.1,2

A Solid Week

Stocks opened the week higher despite weaker-than-expected retail sales. On Tuesday, stocks pulled back on disappointing economic data and renewed Middle East tensions.3,4

Stocks roared higher Wednesday as investors looked forward to the Federal Reserve’s meeting. As widely expected, the Fed kept rates steady, but Fed Chair Powell’s comments buoyed investors’ spirits.5

Stocks dipped Thursday and opened lower Friday, but investors showed some confidence by pushing prices higher into Friday’s close.6

Source: YCharts.com, March 22, 2025. Weekly performance is measured from Monday, March 17, to Friday, March 21. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Fed Stays Positive

Amid all the market turbulence of late, the Fed was a steadying influence.

At his post-meeting press conference, Fed Chair Powell stressed that the economy remained strong and suggested that any impact from tariffs on inflation would be short-term.

But the primary reason investors cheered came down to this: most Fed officials still penciled in two interest rate cuts for this year. In late January, Powell said the central bank was in no hurry to adjust its policy stance, which unsettled the markets.7

This Week: Key Economic Data

Monday: PMI Composite—Services and Manufacturing.

Tuesday: Case-Shiller Home Price Index. Consumer Confidence. New Home Sales.

Wednesday: Durable Goods Orders. St. Louis Fed President Alberto Musalem speaks.

Thursday: Gross Domestic Product (GDP). Trade Balance in Goods. Weekly Jobless Claims. Retail & Wholesale Inventories. Pending Home Sales. Richmond Fed President Tom Barkin speaks.

Friday: Personal Consumption & Expenditures (PCE) Index. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; March 21, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: McCormick & Company, Incorporated (MKC, MKC.V), GameStop Corp. (GME)

Wednesday: Cintas Corporation (CTAS), Paychex, Inc. (PAYX)

Thursday: Lululemon Athletica Inc. (LULU)

Source: Zacks, March 21, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“There’s only one corner of the universe you can be certain of improving, and that’s your own self.” –Aldous Huxley

A Checklist of Common Errors When Preparing Your Tax Return

Properly preparing your tax return can be tricky, but here are some tips to help you avoid common errors:

- Submitting your tax return online ensures greater accuracy than mailing it in. The e-file system can detect common errors and send your filing back to you for you to correct, saving you a ton of time in processing and delays.

- Print or type your full name, taxpayer identification number (SSN), and address (including zip code) clearly.

- Choose only one correct filing status.

- Enter your income on the correct lines and include a Form 1040 to declare additional income and adjustments as needed.

- Put brackets around negative amounts.

- Keep a copy of the signed return and schedules for your records.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

What is Mindfulness?

You may have heard various definitions of mindfulness here and there or have your own ideas about what it is. Do you completely clear your mind? Is there more to it?

Interestingly, mindfulness is as simple as it sounds. It refers to being fully present in where and what you’re doing. You can practice mindfulness while driving, walking your dog, or playing with your children. It’s practicing being in the here and now and not letting your mind take you out of the present moment. These obsessive thoughts can lead to anxiety and stress.

To practice mindfulness, take a simple activity, like drinking your cup of coffee, and think about every sensation you’re experiencing. It takes practice, but is worth it to improve your mental strength!

Tip adapted from Mindful9

Morning mists over the Tarn

Millau, France

Footnotes and Sources

1.The Wall Street Journal, March 21, 2025

2. Investing.com, March 21, 2025

3.The Wall Street Journal, March 17, 2025

4.CNBC.com, March 18, 2025

5.The Wall Street Journal, March 19, 2025

6.The Wall Street Journal, March 21, 2025

7.CNBC.com, March 18, 2025

8. IRS.gov, May 16, 2024

9.Mindful, October 3, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.