Stocks moved lower last week as fiscal fears and fresh tariff threats loomed over market sentiment.

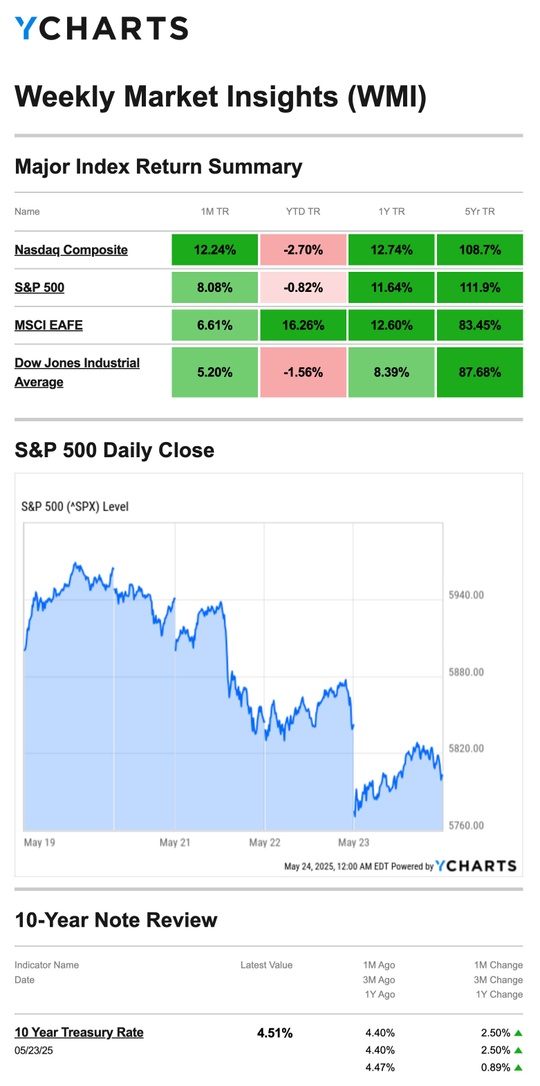

The Standard & Poor’s 500 Index fell 2.61 percent, while the Nasdaq Composite Index dropped 2.47 percent. The Dow Jones Industrial Average slid 2.47 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, advanced 1.14 percent.1,2

Stocks Slip

On Monday, stocks were under a bit of pressure after credit rating agency Moody’s downgraded the U.S. as an issuer of government bonds.3,4

Stocks remained under pressure midweek as Treasury yields moved higher with the 30-year bond hit a 19-month high. Investors fretted about the budget deficit; some feared the deficit would be made worse by the spending bill winding its way through Congress. After the House of Representatives approved the bill, bond yields backed off their highs and stocks went sideways.5,6

On Friday, stocks dropped after President Trump warned of a 50 percent tariff on European Union goods following an apparent stall in trade negotiations. At the same time, the administration also threatened a 25 percent tariff on any iPhones manufactured outside of the U.S.7On Friday, stocks dropped after President Trump warned of a 50 percent tariff on European Union goods following an apparent stall in trade negotiations. At the same time, the administration also threatened a 25 percent tariff on any iPhones manufactured outside of the U.S.7

Source: YCharts.com, May 24, 2025. Weekly performance is measured from Monday, May 19, to Friday, May 23. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Unexpected Tariff News

The president’s fresh tariff talk ended a week or so of relative tranquility on the trade front. While the EU tariff threat may end with a deal similar to deals with other countries and regions, the iPhone issue may prove stickier.

Some analysts estimate that making iPhones in the U.S. would increase manufacturing costs by as much as 50 percent, which might increase the price of an iPhone.8

This Week: Key Economic Data

Monday: Market Holiday

Tuesday: Durable Goods. New York Fed President John Williams and Minneapolis Fed President Neel Kashkari speak. Case-Shiller Home Price Index. Consumer Confidence.

Wednesday: Federal Open Market Committee (FOMC) Meeting Minutes. Neel Kashkari speaks.

Thursday: Gross Domestic Product (GDP). Jobless Claims (weekly). San Francisco Fed President Mary Daly and Chicago Fed President Austan Goolsbee speak. Fed Balance Sheet. Pending Home Sales.

Friday: Personal Consumption & Expenditures (PCE) Index. International Trade Balance in Goods. Atlanta Fed President Raphael Bostic and Austan Goolsbee speak. Retail and Wholesale Inventories. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; May 23, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: NVIDIA Corporation (NVDA), Salesforce Inc. (CRM)

Thursday: Costco Wholesale Corporation (COST), Dell Technologies Inc. (DELL)

Source: Zacks, May 23, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

“You can’t destroy knowledge. You can stamp it under and burn it up and forbid it to be, but somewhere it will survive.”–Leigh Bracket

Help Get Your Federal Withholding Correct With This Tool From the IRS

The IRS has a handy tool called the IRS Tax Withholding Estimator to help taxpayers better understand their withholding. It’s essential to examine your federal withholding periodically to ensure you are comfortable with the amount of tax withheld.

Checking your withholding status may be a good idea to consider if you have experienced a change that may affect your tax status, such as:

- Going through a marriage or divorce

- Having or adopting a child

- Purchasing a new home

- Working two or more jobs at the same time

- Only working part of the year

- Claiming credits such as the child tax credit

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS9

What is Sleep Hygiene?

We all want a better night’s sleep, and your sleep hygiene routine might impact the amount and quality of shut-eye you get. Sleep hygiene refers to your habits to get a good night’s sleep. The better your habits, the better your chances are of improving your sleep.

Here are some good sleep hygiene tips:

- Be consistent with your sleeping and waking times, even on weekends!

- Make sure your bedroom is dark, quiet, and of a comfortable temperature

- Invest in blackout curtains or a white noise machine to drown out light and sound

- Avoid electronic devices, including phones and TV, at least an hour before bed

- If your appliances have a “night” mode, switch this on a few hours before bed to reduce blue light

- Make sure to get enough exercise during the day, which may help you fall asleep faster

Tip adapted from Centers for Disease Control and Prevention10

View of Guatapé

Piedra del Peñol, Colombia

Footnotes and Sources

1.WSJ.com, May 23, 2025

2. Investing.com, May 23, 2025

3.CNBC.com, May 19, 2025

4.CNBC.com, May 20, 2025

5.CNBC.com, May 21, 2025

6.CNBC.com, May 22, 2025

7.WSJ.com, May 23, 2025

8.MarketWatch.com, May 23, 2025

9. IRS.gov, August 20, 2024

10.CDC.gov, December 12, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.